A brand new report from bitcoin and crypto load supplier Genesis Capital reveals some fascinating insights into institutional short-selling of cryptocurrencies. Notably, BTC is used much less for hypothesis than altcoins whereas naysayers Jamie Dimon, Warren Buffett, and Nouriel Roubini aren’t shorting bitcoin.

$425 Million New Mortgage Originations In First Quarter

Crypto-Loans supplier, Genesis Capital has revealed its newest quarterly report and insights, overlaying Q1 2019 and past.

The primary quarter of 2019 continued the upwards development seen on the finish of 2018, with an extra $425 million in new originations. This took the overall since launching the lending enterprise in March 2018 to over $1.5 billion, 38% quarterly development. Lively loans rose 17%, from $153 million to $181 million.

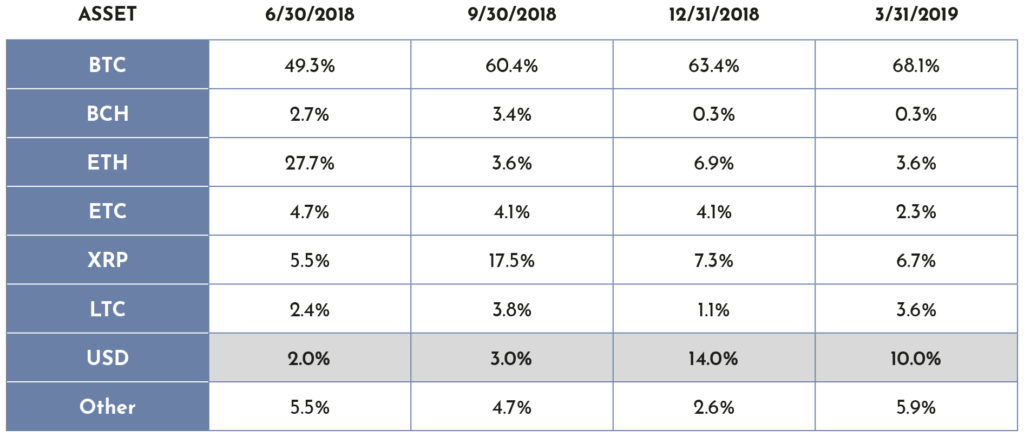

BTC nonetheless dominates Genesis’ loan-book, growing barely to make up 68% of the mortgage portfolio. Bitcoin is exhibiting constant borrowing demand from “market-makers and high frequency trading firms that need working capital for arbitrage opportunities.”

USD loans, utilizing cryptocurrency as collateral, have grown to 10% of the energetic mortgage portfolio, following their introduction in This autumn 2018.

Borrowing Developments And Masking Shorts

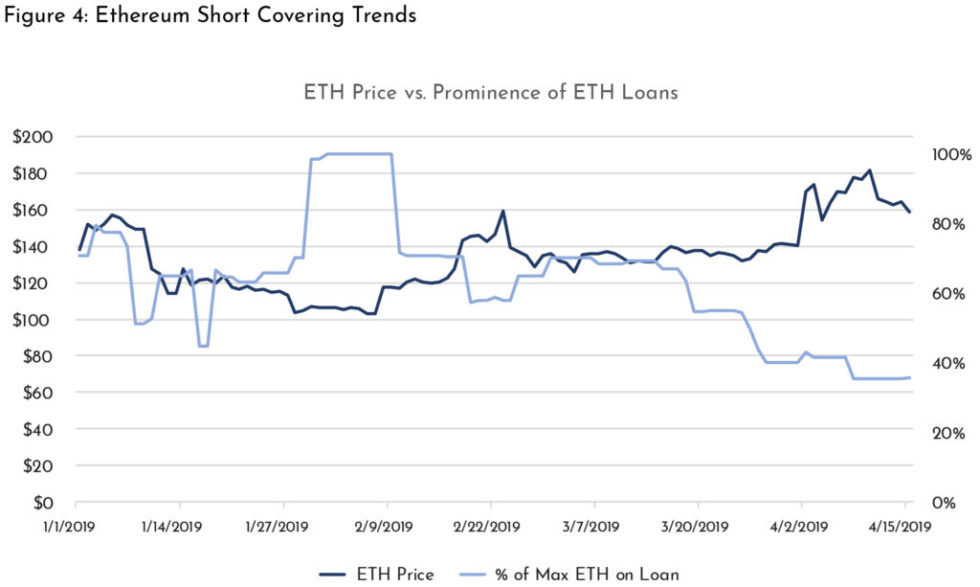

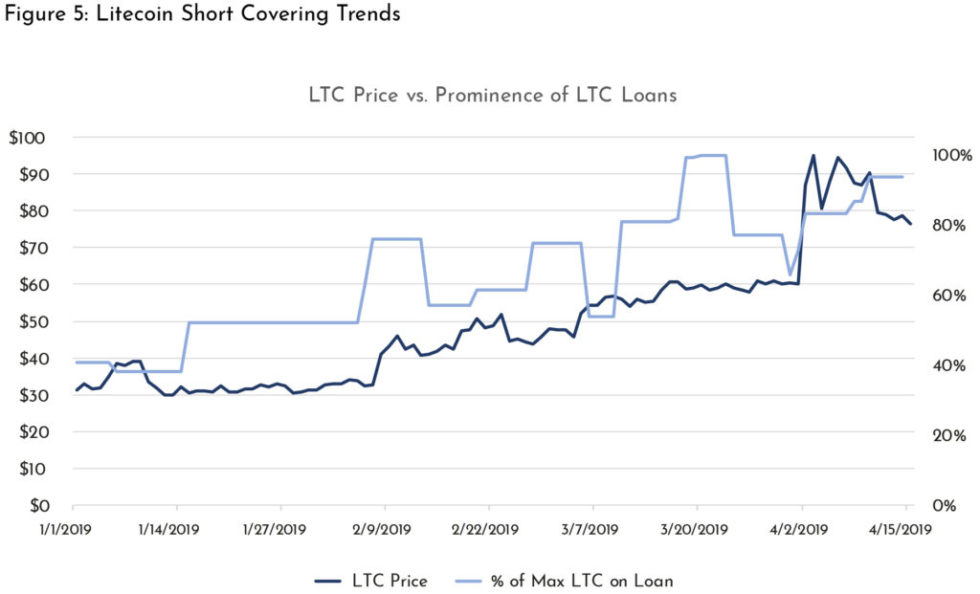

Genesis revealed two charts within the report, indicating prominence of loans in opposition to value, for each ETH and LTC.

For Ethereum, mortgage prominence correlates inversely to ETH value 00. This means an elevated curiosity in taking a mortgage of ETH to quick in opposition to when the worth is already low.

As may be seen, the mortgage excessive in February drops simply after the worth begins to rally. So many shorts have been doubtless coated after the worth had moved in opposition to their place. Conversely, earlier than the April rally, nearly all of shorts have been coated effectively earlier than value began to show.

Litecoin, nonetheless, rallied all through the quarter, giving an perception into the shorting psychology. LTC loans enhance in prominence after every value spike, as shorters anticipate the asset to return to pre-spike ranges. It’s notable that almost all of those shorts are coated earlier than the worth spikes once more, suggesting higher info on or understanding of the asset.

Naysayers Like Warren Buffett Not Shorting Bitcoin

BTC loans didn’t present the identical correlation with bitcoin value 00, as an alternative rising steadily all through the quarter. Genesis are presently lending over 30,000 BTC.

Some suggestion that the enterprise mannequin encourages naysayers and bearish market individuals by enabling massive block OTC short-selling. Nevertheless, Genesis say that they haven’t seen this kind of counter-party.

These individuals who’re shorting are sometimes lengthy one thing else, solely quick for a small window, and/or managing hedge funds which can be long-term bullish on the house. In different phrases, Dimon, Buffett, and Roubini aren’t shorting. It’s straightforward to say one thing is nugatory however it’s tough to place capital behind that place and justify the danger of being web quick on this market.

As Bitcoinist reported final 12 months, Invoice Gates claimed that he would quick Bitcoin if there was a straightforward approach to do it. Till that’s, one of many Winklevii identified that there’s, through Bitcoin futures contracts.

What do you consider these lending market tendencies? Share your ideas beneath!

Pictures through Shutterstock, Genesis Capital

The put up ‘Warren Buffett’ Isn’t Shorting Bitcoin: New Crypto Mortgage Report Concludes appeared first on Bitcoinist.com.