Demand for Gemini alternate’s native stablecoin, Gemini greenback (GUSD), has dropped considerably during the last 7 months whereas different pegged-value belongings proceed to soar.

Gemini Greenback Falls Behind

The market capitalization of the dollar-pegged token has been on its approach down since December 20, 2018. It has slipped from an all-time excessive of $103.106 million to $7.981 million on the time of this writing, marking a 92.25% drop in simply seven months. The identical interval has witnessed the bitcoin worth hovering from $3,126 to $10,336.17, up by greater than 230 %.

Gemini Market Cap is on a Regular Decline | Picture Credit: CoinMarketCap.com

In distinction, different stablecoins are faring much better than Gemini Greenback. Paxos Commonplace Token, as an illustration, has a market capitalization of circa $168 million. On the identical time, Circle’s USDC is towering excessive at a provide of circa 406.34 million. Final however not least, the main stablecoin Tether (USDT) has a complete amount of $4.25 billion, calculated at press time.

Competitors is a Killer

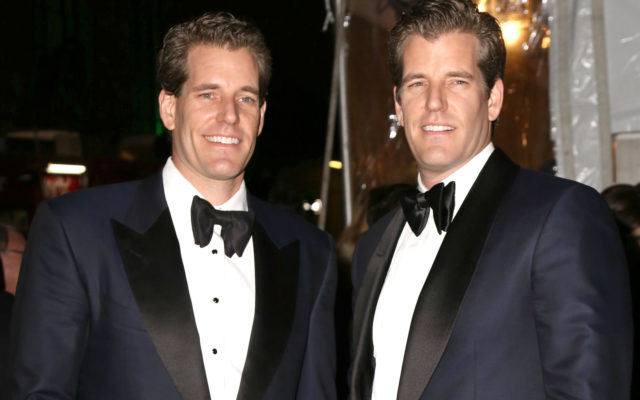

Compared to its friends in the US, Gemini alternate notices much less commerce visitors on its platform. Knowledge supplied by CoinGecko exhibits that the Winklevoss Twins’ agency is on the 21st rank within the final 24 hours – with simply $60.275 million in every day quantity. Coinbase Professional, one other US-regulated entity, is internet hosting about $602.93 million price of trades on its alternate – 10X the variety of buying and selling quantity that Gemini is reporting.

On the identical time, San Francisco-based Kraken alternate is processing $340.30 million price of trades on its platform.

The absence of an enough aggressive edge could possibly be one of many explanation why the demand for Gemini greenback could possibly be dropping. As a dollar-pegged entity, the token permits merchants to change between crypto-assets easily with out having to transform their cryptocurrencies to the US greenback. Because it seems, not many merchants demand GUSD, which could possibly be as a result of Gemini’s presence in a strictly regulated monetary market.

Union Station, Washington DC, @Gemini adverts plaster the partitions. We’re rising

pic.twitter.com/3BJQEgXr7w

— Crypto Gumb

(@derekGUMB) July 18, 2019

https://platform.twitter.com/widgets.js

There are different aggressive components in play, in the meantime. Tether’s USDT is extra seen throughout the non-US exchanges, particularly Binance, regardless of its contentious standing. USDC, then again, has a broader clientele in Coinbase and Circle. Paxos is extra-feasible for its means to create and redeem stablecoins immediately.

And above all, even the merchants outdoors the Gemini alternate should not retaining many Gemini {dollars} of their profiles. The group believes it’s due to a rebate program Gemini launched on the time of the launch of GUSD. The agency supplied buying and selling firms its stablecoins in reductions in hopes to cut back Tether’s market dominance. However it seems these firms exchanged stockpiles of discounted GUSD models one-to-one for Tether’s USDT and different stablecoins, thus incomes free cash.

The Nice Gemini Greenback Rebound

The demand for Gemini Greenback may go up as founders Cameron and Tyler Winklevoss prepares Gemini to grow to be a broker-dealer. The twins have utilized for a license on the Monetary Business Regulatory Authority (FINRA). Upon approval, Gemini would be capable of supply to commerce in securities, which may increase the demand for GUSD.

Picture by way of Twitter @derekGUMB, Coinmarketcap, Shutterstock

The put up What’s Occurred to Gemini Greenback? Provide Down 92% YTD appeared first on Bitcoinist.com.