Bitcoin seems to be again on the rise however will altcoins observe? Alex Krüger thinks not.

Bitcoin is King

Earlier this week, economist and crypto analyst Alex Krüger tweeted that in his opinion, nearly all of altcoins have “become asymmetric bets with an unattractive return profile.”

Exterior of February – April’s spectacular altcoin rally (Alt Season) the place quite a few altcoins posted 300% to 500% features, altcoins have carried out poorly in opposition to Bitcoin since late April.

Altcoin to Bitcoin pairings have taken an absolute beating, and altcoin to fiat pairings have additionally endured some darkish days.

Krüger’s commentary that “alts consistently underperform BTC on down days, and only sometimes outperform BTC on up days” aligns with an in depth report launched by Coin Metric’s final week.

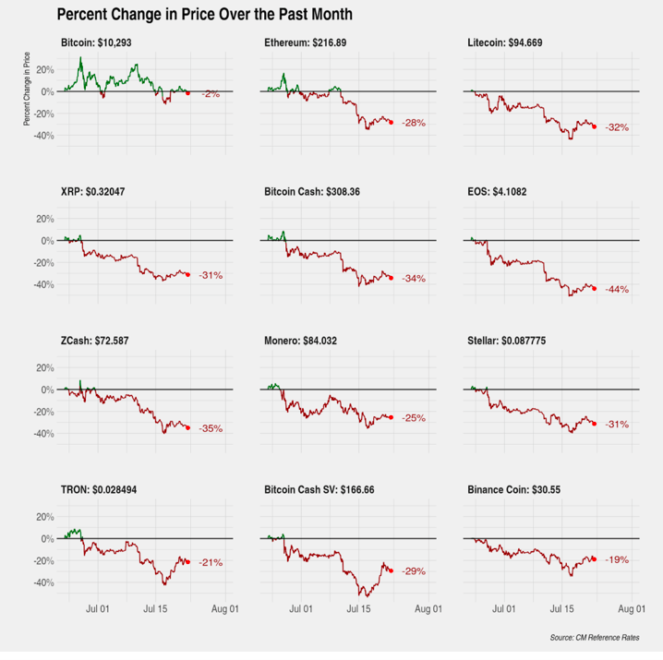

Knowledge from the report exhibits that over the month of July nearly all of altcoins have been down greater than 40%. This got here as Bitcoin had solely dropped 2% on the time of the report’s publication.

The report identified that EOS (-44%), Cosmos (-41%), Cardano (-37%), Tezos (-6%), VeChain (-10%) have been “notable underperformers”.

Regulatory Stress is Impacting all Cash

The report factors to geopolitical, macro-economic, and regulatory components as the first affect upon Bitcoin and altcoin value motion.

Continued regulatory strain on the cryptocurrency exchanges led to Bittrex, Binance, and Poloniex implementing new insurance policies that bar U.S. merchants from spinoff devices and sure digital property.

The CFTC additionally launched an inquiry into BitMex over allegations that the change allowed U.S. residents to commerce on its platform. These actions seem to have shaken investor confidence in altcoins and led to their poor efficiency.

Fb’s reveal of its Libra token project additionally excited Bitcoin traders however the next regulatory strain introduced on by U.S lawmakers appears to have negatively impacted Bitcoin value.

Moreover, U.S. Treasury Secretary Steven Mnuchin’s feedback about stringently regulating Bitcoin shoot confidence as these statements circulated all through mainstream media.

The Huge Image Favors Bitcoin

From a macroeconomic perspective, many nations are gravitating towards financial easing and traders are cautious {that a} world recession may slowly be within the making. Coin Metrics factors out that:

It now appears practically sure that the 4 main central banks of the world (the Federal Reserve, the European Central Financial institution, the Financial institution of Japan, and the Individuals’s Financial institution of China) are on the cusp of one other financial easing cycle. As actual rates of interest decline, the chance price of holding non-yield producing property like Bitcoin declines.

Solely time will inform whether or not or not altcoins discover some power and regain the massive swathes of territory which have been forfeited to Bitcoin over the previous few months. To be frank, till Bitcoin’s dominance price drops, it appears extremely unlikely.

Do you suppose altcoins will recuperate earlier than the tip of 2019? Share your ideas within the feedback beneath!

Picture through Shutterstock, CM Reference Charges, Twitter:@krugermacro

The publish When It Involves ROI, Altcoins Are No Match For Bitcoin: Analyst appeared first on Bitcoinist.com.