The profit for the planet could also be incalculable by switching to a sound cash like Bitcoin from inflationary ‘cheap’ cash that incentivizes waste, incessant development, and profligate consumption.

New Know-how Requires New Pondering

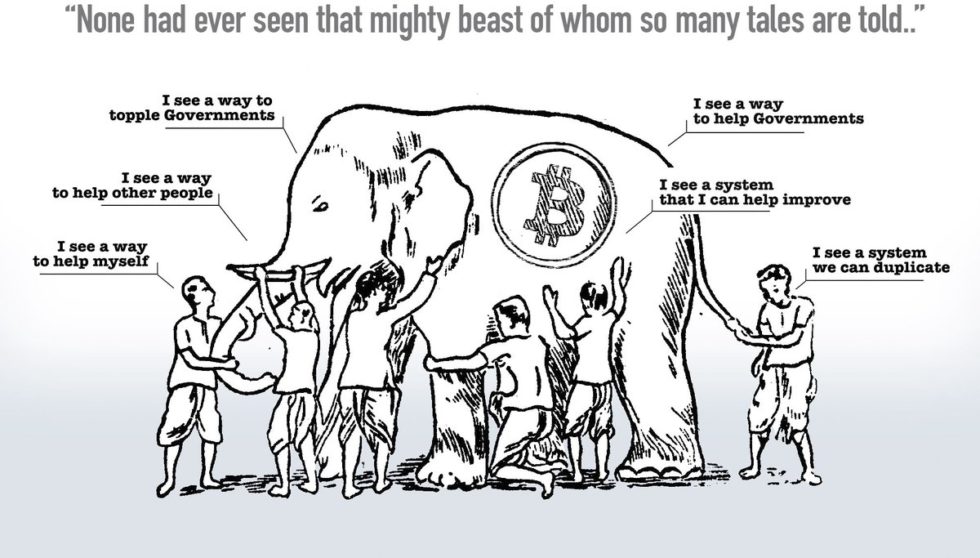

In the present day, most commentators try and outline Bitcoin utilizing analogies. They evaluate it to issues they’re aware of like shares, commodities, or a cost service like PayPal.

Similar to the auto was first described as a horseless carriage, Bitcoin at this time is offered largely as digital pseudo-money that’s not backed by any authorities.

Equally, Bitcoin mining has been closely criticized within the mainstream media. Headlines like Bitcoin makes use of extra power than *insert nation* will not be unusual; and are frequently rehashed and republished.

Such findings, nevertheless, have been debunked time and time once more. (Right here’s an amazing article explaining Bitcoin’s power use.) In the meantime, related issues associated to the banking system are intentionally ignored.

However Bitcoin will not be just like the inflationary fiat cash that drives the worldwide economic system at this time. It possesses the properties of sound cash. In contrast to the greenback, it’s deflationary, non double-spendable and un-counterfeitable. This makes it a totally completely different animal and requires some new pondering to grasp its potential.

Inflation Incentivizes Profligate Consumption

Greenback hegemony, Keynesian pondering and inflation have now formed financial coverage for generations. Everlasting Quantitative Easing (QE) and even unfavourable rates of interest have gotten the brand new regular. So it’s not stunning that one thing like Bitcoin is meaningless to most individuals at this time.

Inflationary financial insurance policies drive companies into excessive time choice pondering. This implies chasing fast quarterly earnings, borrowing ‘cheap’ cash, and doing no matter it takes to develop in any respect prices.

In the present day, most companies conceal behind a veneer of environmentalism to promote extra merchandise. Earth tone tote luggage, less-plasticky plastic bottles, inexperienced logos, recycled supplies and so on. Something to spice up revenue margins and ease over-consumption worries within the minds of the patrons. In consequence, if the product is ‘eco-friendly’ customers really feel much less responsible about shopping for that new smartphone yearly.

Low cost Cash Doesn’t Care Concerning the Future

The inflationary cash phenomenon leads to what is named the Cantillon impact, the place these closest to the cash printers set the tone of financial exercise.

Massive companies profit, specifically, as they get particular entry to the central financial institution’s low cost window. This ‘cheap money’ incentivizes borrowing and excessive time choice selections that are likely to prioritize amount over high quality.

This additionally has a huge impact on the time preferences of the inhabitants too. Excessive inflation, or the discount of buying energy of cash, means people may also have a excessive time choice.

That is particularly evident in hyper-inflationary economies. Individuals will rush to spend their cash as quickly doable realizing that it’ll be nugatory the subsequent day.

Bitcoin investor, Jimmy Music, explains the distinction between a low time choice versus a excessive time choice particular person. He says:

A low time choice particular person is keen to forego issues now for one thing higher later.

A bunch of excessive time choice folks won’t assume very a lot concerning the future. As an alternative of saving for tomorrow, they’ll spend now, eat and never be very productive. They received’t be saving for tomorrow, beginning companies or constructing giant scale tasks as all of them require numerous planning.

Sound Cash is Inexperienced Tech

So maybe we shouldn’t be specializing in whether or not Bitcoin ‘wastes’ kind of electrical energy than at this time’s monetary system. As an alternative, we needs to be asking whether or not sound cash would change how we worth our time, labor and our surroundings, notably for future generations.

“[Unrealized capital gains tax] and fiat cash have the same final result. Distortion of time choice from investing sooner or later in the direction of current consumption. Encouraging hedonistic exercise and thus extra environmental destruction, says Bitcoin Middle NY co-founder, Austin E. Alexander.

In different phrases, Bitcoin might curb the excessive time choice, growth-focused financial insurance policies of at this time that incentivize profligate consumption, environmental hurt and sure…numerous wasted power.

For this reason the implications of a Bitcoin customary could also be “incalculable,” says economist and creator of The Bitcoin Normal, Saifedean Ammous. He explains:

The advantages incurred from [switching from the horse to the automobile] are incalculable for us, primarily by not having to take care of horse manure as a everlasting fixture of life. In a really related manner, the advantages of bitcoin lie within the horrors it could enable us to keep away from by taking cash manufacturing out of the arms of the state’s violent Keynesian barbarians.

Bitcoin, however, supplies a nuetral, sound cash different. Its digital shortage on account of its 21 million cap and counterfeit-proof nature, makes it deflationary.

Switching to a Bitcoin customary will surely assist decrease people’ time preferences and sure, might in the end be very, superb for the surroundings.

Do you agree {that a} sound cash like Bitcoin could also be good for the planet? Share your ideas beneath!

Photos by way of Shutterstock

The publish Why Bitcoin Could Be The Greenest Know-how Ever appeared first on Bitcoinist.com.