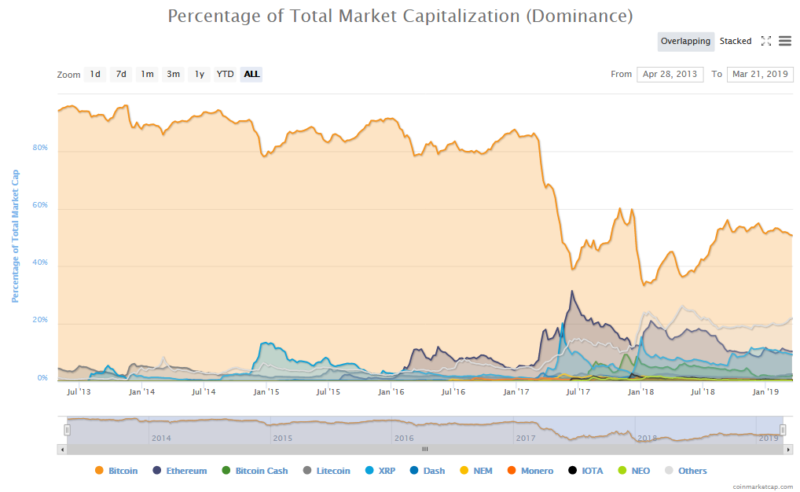

The Bitcoin (BTC) market capitalization dominance at the moment being at its lowest stage in seven months is just not precisely unhealthy information. Why? As a result of the bottom Bitcoin dominance indices have traditionally coincided with the next bitcoin worth.

Bitcoin Dominance Slips Regardless of Worth Acquire

In keeping with CoinMarketCap information, the BTC market dominance now stands at 50.eight %. This determine represents the bottom market dominance since mid-August 2018.

Information exhibits that Bitcoin’s share of the full cryptocurrency market capitalization has been sliding downwards for the reason that latter a part of January 2019. The drop in market share comes regardless of Bitcoin worth trending upwards within the final 4 weeks.

As beforehand reported by Bitcoinist, BTC completed the week ending March 17, 2019, on a optimistic be aware to make it 4 consecutive weekly positive aspects. The final time, BTC loved such a run was in April 2018.

Bitcoin Optimism Continues to Develop

Dominance slide or not, there may be rising optimism amongst BTC bulls as to prospects of the cryptocurrency in 2019. Bitcoin buying and selling guru, Tone Vays says he predicts BTC at $6,000 as lengthy it breaks the $4,200 barrier.

However Vays isn’t the one one who sees BTC going past the $5,000 mark with TRON CEO, Justin Solar forecasting that Bitcoin would commerce between $3,000 and $5,000 in 2019.

Tom Lee of Fundstrat, in a market outlook delivered at first of the yr, additionally declared a reversal of detrimental market components including to a tailwind that might push BTC worth larger in 2019.

Ought to a declining dominance represent a fear for Bitcoin customers? Nicely, historic information exhibits the other because the lowest Bitcoin dominance index ever recorded was round 32 % in December 2017 when the BTC worth was at its document excessive of $20,000.

Altseason Dilutes BTC Market Share

So, with constant worth positive aspects over a major period of time, why then is the BTC dominance index slipping. The pattern appears most certainly because of the regular rise of the altcoin market worth diluting the BTC market share.

Bitcoin Money (BCH) is up a whopping 22 % within the final seven days, with Litecoin (LTC) and Ethereum (ETH) additionally posting spectacular 7-day positive aspects. All high ten altcoins are at the moment exhibiting optimistic worth actions over the past seven days as effectively.

Sure. This is without doubt one of the indicators. The writing is on the wall. https://t.co/FAQOFtocQP

— Mati Greenspan (@MatiGreenspan) March 20, 2019

https://platform.twitter.com/widgets.js

Exterior of the highest ten, tokens like Maximine Coin, KuCoin Shares, Ravencoin, and Huobi Token have additionally surged greater than 50 % throughout the similar interval. Dubbed “altseason,” the large worth improve of many altcoins on the similar time is having a detrimental affect of BTC dominance.

The whole cryptocurrency market capitalization now stands at $141 billion, its highest stage since late February 2019, little question partly because of the present altcoin resurgence. Large worth positive aspects apart, some consultants like Mati Greenspan, Senior Market Analyst at eToro, say buyers shouldn’t get carried.

In a tweet revealed on Thursday (March 21, 2019), Greenspan stated:

Ginormous worth motion is just not a sign of a worthwhile token. Please keep protected throughout this #altseason and all the time #DYOR earlier than investing.

Nonetheless, one pertinent query is whether or not this affect on dominance extends exterior market capitalization figures; a metric which regularly will get lots of flak from many consultants.

Furthermore, Bitcoin customers most likely shouldn’t be too involved. The bottom Bitcoin dominance index ever recorded was round 32 % in December 2017 when the BTC worth was at its document excessive of $20,000.

Do you contemplate market dominance a significant indicator? Share your ideas with us within the feedback beneath!

Photos courtesy of CoinMarketCap and Twitter (@MatiGreenspan), Shutterstock

The submit Why Bitcoin Dominance Dropping to 7-Month Low is Bullish for Worth appeared first on Bitcoinist.com.