On-chain data suggests Satoshi’s original vision is alive and kicking as the Bitcoin network has shifted towards smaller transactions.

Bitcoin P2P Payment Transfers Have Been Gaining Steam Recently

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has talked about a pattern shift on the BTC network regarding transactions that may be classified as peer-to-peer (P2P) payments.

First, Ju has discussed the trend in the transaction fees on the Bitcoin network. The “transaction fees” here naturally refer to the fees that senders on the blockchain have to attach with their moves as compensation for the validators.

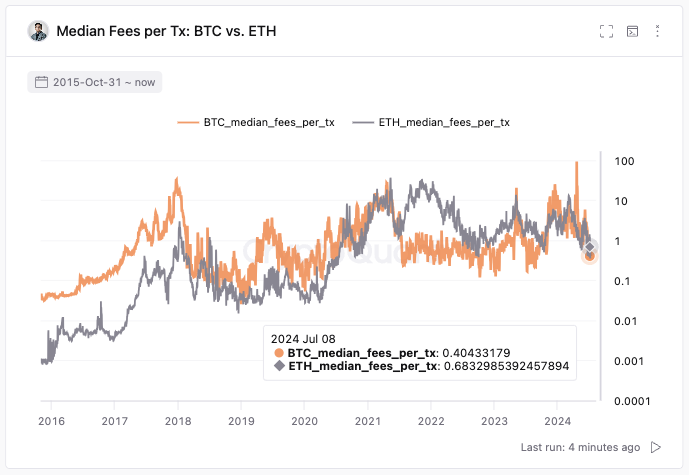

Below is the chart shared by the CryptoQuant CEO that shows how the median transaction fees on the BTC network have compared to those on Ethereum over the past decade.

Both the networks appear to have seen a cooldown in fees in recent months | Source: @ki_young_ju on X

As the graph shows, median transaction fees on Bitcoin had been greater than on Ethereum pre-2021, but since then, the metric has generally been lower for BTC. As Ju notes,

Contrary to the common belief that Bitcoin tx fees are always higher than Ethereum’s, BTC tx fees have been cheaper than ETH’s for most of the time since 2021.

The median fee on BTC is around $0.40, while that on ETH is about $0.68. Now, if users have to use Bitcoin as a mode of payment, they would only use it for transfers large enough to make this fee worth it.

“Considering the 1-3% Tx fee rate in developing countries, $13-40 would be the lower limit,” says the CryptoQuant founder. Thus, to filter the data for only transfers likely to represent P2P payments on the network, the analyst has chosen transactions falling within the $40 to $1,000 range.

Below is a graph plotted between the daily median transaction value (USD) and the daily transaction count for various periods.

Looks like transactions have recently been getting smaller in size | Source: @ki_young_ju on X

The transactions here exclude the Runes and Ordinals-related moves since transfers related to these protocols don’t exactly correspond to real-life P2P payments.

From the chart, it’s apparent that the median size of these transactions had been towards the upper end between 2019 and 2022, but since 2023, the transfers have become smaller.

Not just that, the number of transactions has also increased simultaneously, suggesting many small moves are happening now. Ju believes this is likely due to real-life P2P payments.

Therefore, while some may think that Bitcoin hasn’t lived up to Satoshi’s vision when making the cryptocurrency, data would suggest Bitcoin has been developing in the correct direction recently.

BTC Price

Bitcoin hasn’t been able to recover much so far, as its price is still trading at around the $57,800 level.

The price of the coin appears to have been sliding over the past month | Source: BTCUSD on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com