After six shaky weeks, starting in June, when Bitcoin plunged by over 15%, the coin is returning. As of this writing, prices continue to print higher highs, floating above $62,000.

Bitcoin Shaking Off Weakness

According to one analyst, pointing to on-chain metrics supplied by CryptoQuant, Bitcoin is turning the corner. There could be more gains in the coming few weeks or months. Technically, Bitcoin is within a bullish breakout formation, with a close above $60,000 critical for driving confidence.

In the analyst’s preview, the last few weeks had Bitcoin bulls fighting a wave of fear, uncertainty, and doubt (FUD) news. Of note, the decision by the German authorities to offload 50,000 BTC worth billions dented sentiment.

The situation worsened when Mt. Gox creditors said they planned to distribute coins in July, not October. As of July 16, Kraken reportedly emailed recipients that they plan to distribute BTC from Mt. Gox in the next few days.

Falling Bitcoin prices in the better part of June, concluding in a climactic sell-off in early July, caused spot Bitcoin ETFs to register outflows. Unlike in previous months, when investors were keen on gaining spot ETF exposure, the drop made some holders redeem shares, accelerating the downtrend.

Around the same time, the United States Federal Reserve said it would slash rates only once this year, not three times as economists had predicted. This meant interest rates would remain higher than expected, net bearish for risky assets like Bitcoin and cryptocurrencies.

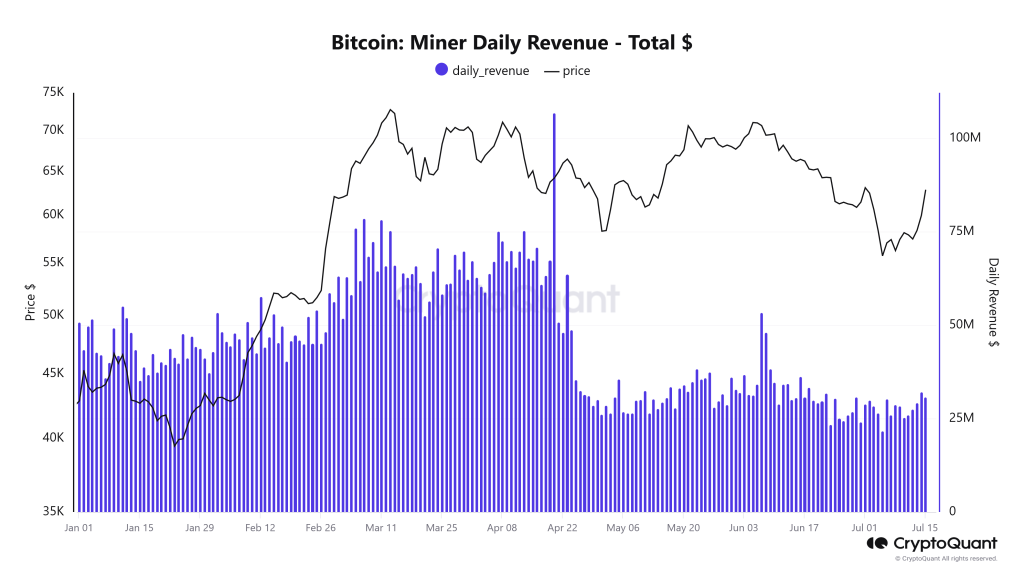

The Major Turnaround: BTC Trading At A Premium, Miners Relieved

However, the turnaround was this weekend. In the analyst’s assessment, the attempt on Donald Trump’s life only increased the probability of the former president taking over from Joe Biden. Trump has changed his stance on Bitcoin and crypto, even encouraging mining activity in the country.

The lift-off over the weekend comes at the back of rising liquidity, especially for leading stablecoins like USDT and USDC. Now, with prices higher, the analyst also noted that short-term holders (STHs) are back in the green after prices broke $62,700.

Higher prices also translated to more earnings for miners. As things stand, miners are no longer in the “extremely underpaid” zone. For this reason, few will be incentivized to sell.

The spike in valuation also means Coinbase clients are paying a premium to receive BTC. This signals that the momentum for even more gains is gradually being built, a huge development for buyers.

Feature image from Canva, chart from TradingView