The ICO increase got here, went, and in line with Larry Cermak, won’t ever return once more.

Preliminary Coin Choices Boomed then Burst

Earlier this week analysis analyst Larry Cermak boldly proclaimed that the 2017 ICO increase was certainly a bubble that can by no means get better.

If true, the information will strike worry into the bag heavy hearts of buyers who backed up the truck and loaded up on altcoins that are these days affectionately known as ‘shitcoins’.

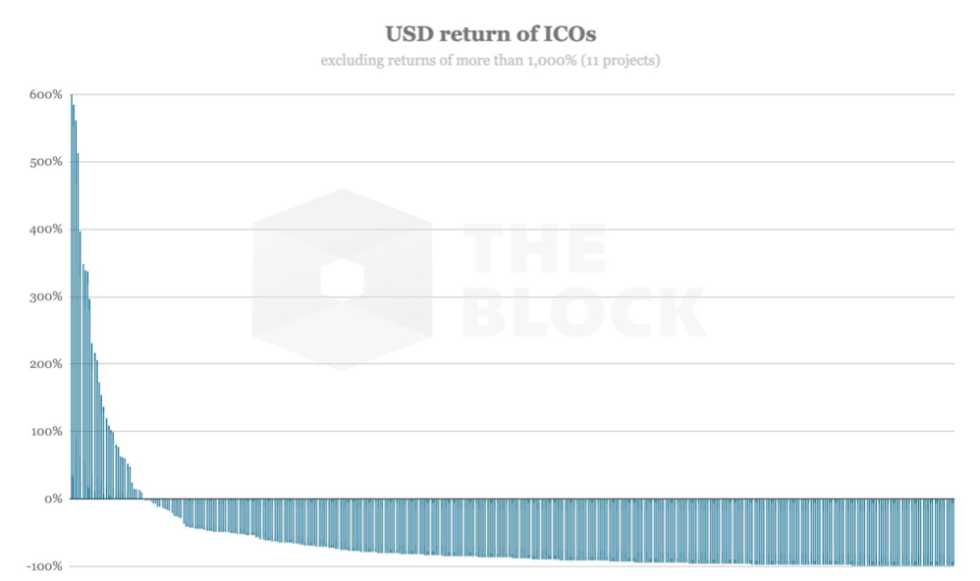

So far, the median USD return supplied by Preliminary Coin Choices is -87 p.c and the determine continues to plummet.

USD return of ICOs

In line with knowledge supplied by Cermak, the ICO increase ultimately burst due to “misaligned incentives between founders and investors.”

It’s now widespread data that along with elevating funds from ‘unsophisticated’ retail buyers, many token gross sales tasks mismanaged funds and had been nowhere close to having a multivariate product.

Many startups additionally misplaced the capability to perform because the observe of preserving the majority of their funds in Ethereum and Bitcoin backfired when the market turned bearish proper at the beginning of 2018.

Firstly, public token gross sales had been a revolutionary approach of elevating funds and seemed to be an equalizer that gave the typical unaccredited investor entry to funding alternatives usually reserved for enterprise capitalists and institutional buyers.

The disadvantage was this unconventional methodology of fundraising left buyers with little authorized recourse for making a declare on tasks that proved to be fraudulent or mismanaged.

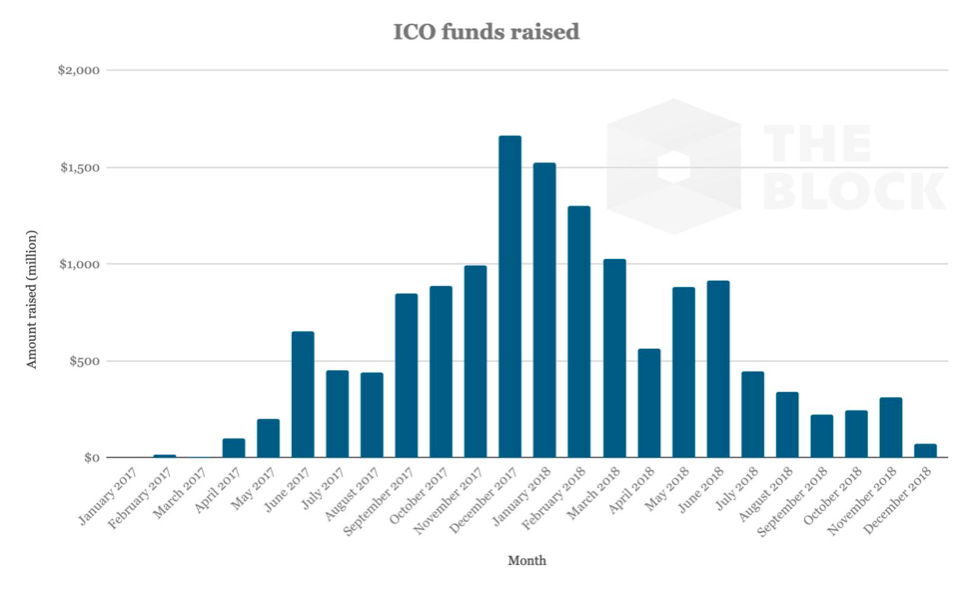

Because the chart reveals, the quantity of funds raised by way of ICO has dropped precipitously since January 2018.

Funds raised by ICOs

Much more disturbing is the truth that:

ICO return knowledge is even more durable to return by; just because many of the tasks have already closed their doorways or as a result of their tokens are fully illiquid.

ICOs Faired Even Worse Towards Bitcoin

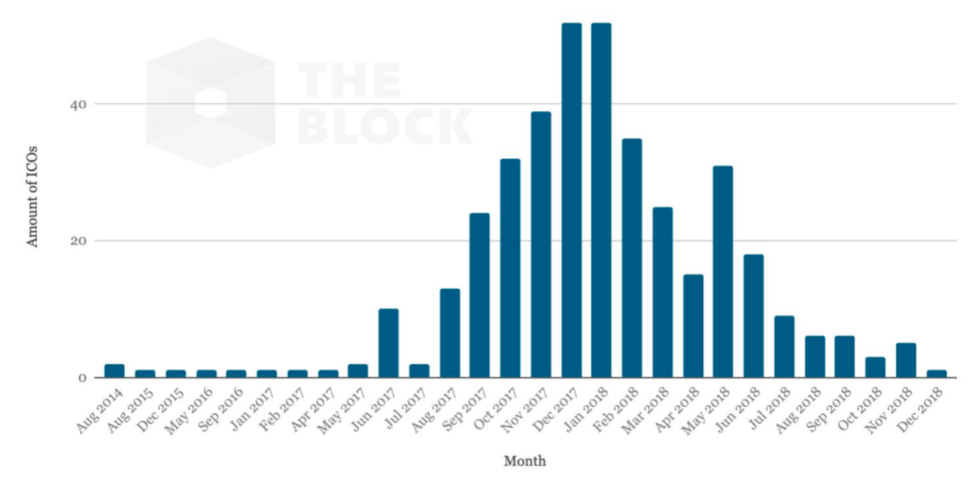

Cermak’s assertion that ICOs won’t ever re-attain their 2017 valuation is supported by knowledge exhibiting that the unfold of crowdsale funding development and the whole variety of ICOs peaked in December 2017.

Numbers of ICOs carried out

Much more attention-grabbing is the truth that solely 10.8% of ICOs nonetheless present a constructive return in USD.

Cermak notes that this determine could be considerably decrease if knowledge from all Preliminary Coin Choices had been included. Cermak discovered that “the median USD return is -87% [and] there have been 11 ICOs with a return of more than 1,000%.”

In comparison towards Bitcoin, “only 30 ICOs (7.7%) have outperformed Bitcoin” and Cermak discovered that 74% of all ICOs dropped greater than 90% in BTC phrases.

Cermak mentioned:

The median BTC return is -91%.

Will IEOs Observe ICOs?

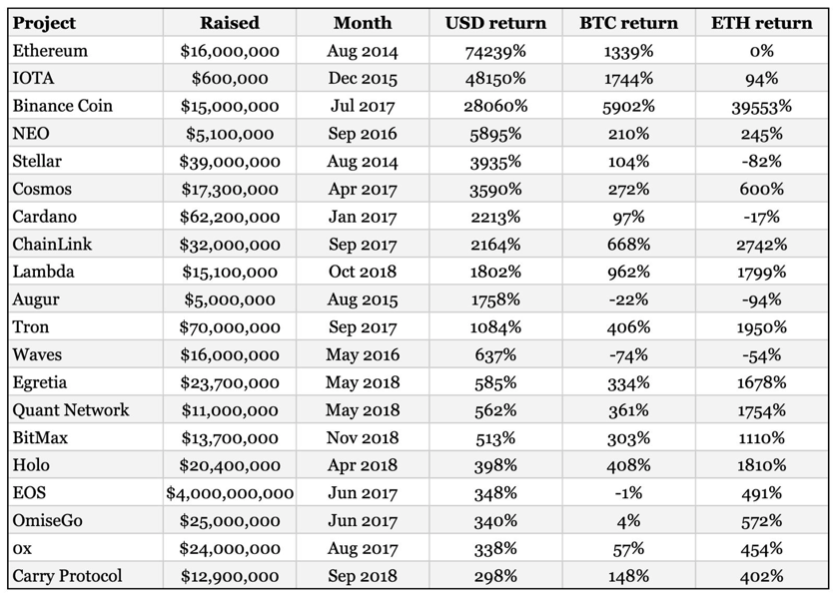

As for ‘successful’ Preliminary Coin Choices, buyers who took a place in BNB, IOTA, Ethereum, Lambda, and ChainLink shall be totally happy to know that these are the 5 highest-performing crypto crowdfunding campaigns in BTC phrases.

For these questioning in regards to the efficiency of all the opposite ICOs, Cermak was variety sufficient to supply the next chart:

Cermak concludes by encouraging buyers to think about that if 89% of all Preliminary Coin Choices produced a adverse USD return and if IEOs are “starting to manifest the same trend”, then what would possibly this imply for future IEOs?

Do you assume IEOs will ultimately all comply with the identical path as ICOs? Share your ideas within the feedback beneath!

Photographs through Shutterstock, Twitter: @lawmaster

The submit 2017’s ICO Growth Was The Bubble That Will By no means Recuperate appeared first on Bitcoinist.com.