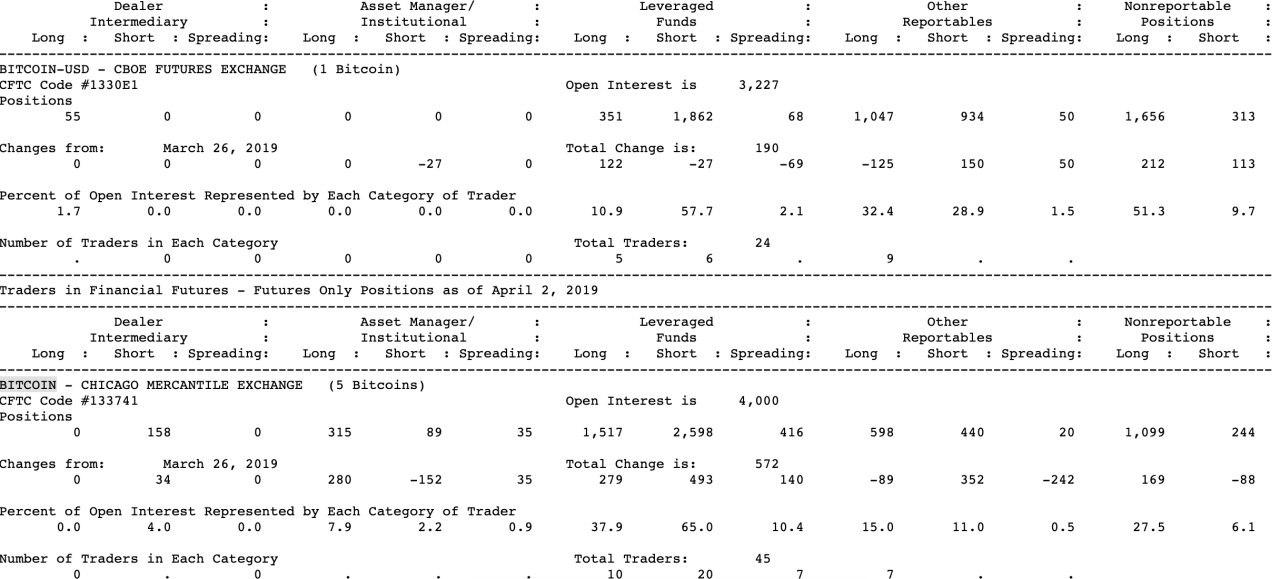

Information from the US Commodity and Futures Buying and selling Fee reveals that institutional traders flipped bullish on Bitcoin as of April 2nd. The date coincides with the newest bitcoin value rally when it soared from round $4,100 to greater than $5,300 in minutes.

Sensible Cash Goes Lengthy on Bitcoin

Information from the US CFTC reveals that the variety of opened lengthy Bitcoin futures contracts by asset managers and institutional traders on the Chicago Mercantile Change (CME) elevated between March 26th on April 2nd.

Notably, 315 lengthy Bitcoin futures contracts on CME’s platform have been opened by April 2nd. It is a whopping 88 % enhance in comparison with the earlier week. Furthermore, the variety of quick positions noticed a 63 % lower – from 241 to 89 contracts.

Every CME Bitcoin futures contract represents 5 BTC, that are cash-settled. Which means as soon as the contract expires, the consumer received’t obtain a physically-delivered Bitcoin however US {dollars} as an alternative.

One other factor to notice is that the whole variety of opened lengthy and quick positions on CME on that date was 404. From these, 78 % have been lengthy, whereas solely 22 % have been quick.

This modification in sentiment might be signalling that insitutional traders at the moment are turning bullish on Bitcoin as curiosity is on the upswing.

Bitcoinist reported that institutional Bitcoin buying and selling quantity has continued to develop for Four consecutive months. To this point in April, it seems that many of the sensible cash is betting on bitcoin to rise in worth. CME Group is principally chargeable for the rise, particularly after the Chicago Board Choices Change (CBOE) introduced again in March that it received’t supply any new Bitcoin futures contracts.

In the meantime, BTC/USD 00 is up nearly 40 % from its mid-December value lows.

It’s Not Simply Establishments

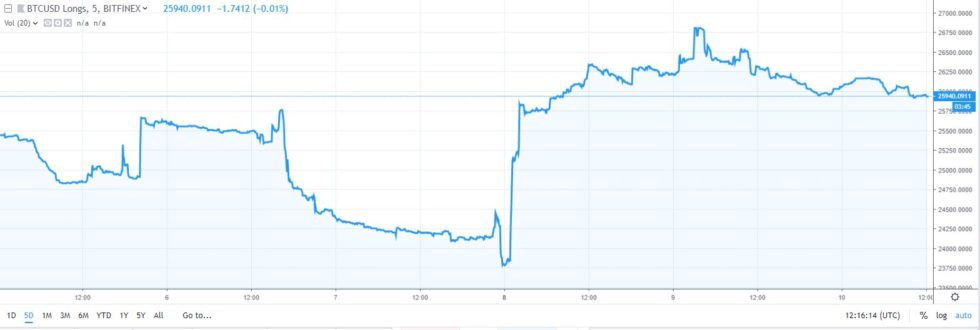

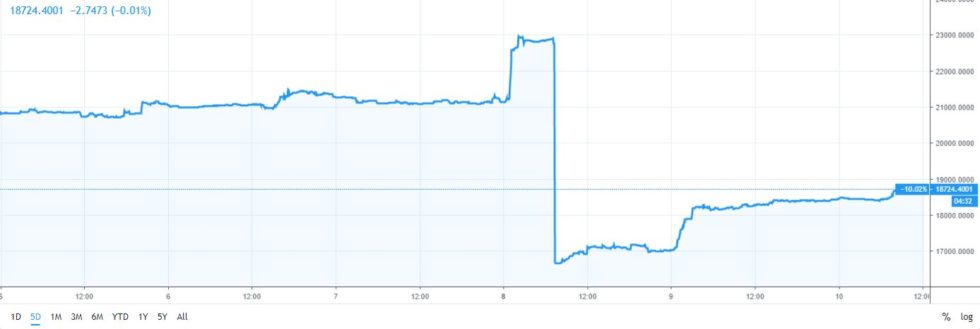

The newest Bitcoin rally has seemingly modified the bearish sentiment amid retail merchants as nicely.

Information from TradingView exhibits that the variety of lengthy positions on cryptocurrency trade Bitfinex additionally elevated over the previous 5 days.

However, the variety of quick positions has decreased considerably. This means that sentiment flipped bullish on April eighth, which can be when lengthy positions surged.

In the meantime, impartial analyst Willy Woo has give you an evaluation that means that the extended bear market could also be coming to an finish. The surge above $5,000 marks the start of a brand new longer-term uptrend.

The bullish sentiment is additional echoed by veteran dealer Peter Brandt. He’s recognized for calling Bitcoin’s final parabolic advance at $20,000, whereas additionally predicting an 80 % decline to underneath $4,000.

Brandt has just lately stated that it wouldn’t shock him if “BTC enters a new parabolic phase.”

Are establishments driving the bitcoin value rally? Share your ideas under!

Photographs through Shutterstock, Tradingview.com

The publish Establishments Elevated Bitcoin Longs By 88% Simply Earlier than Value Rally appeared first on Bitcoinist.com.