The Grayscale Bitcoin Belief is marking notable good points for the reason that starting of 2019, regardless of the rising premium within the product in comparison with Bitcoin’s internet asset worth (NAV). In keeping with some, this can be a signal of institutional internet shopping for and that new cash is coming into the market.

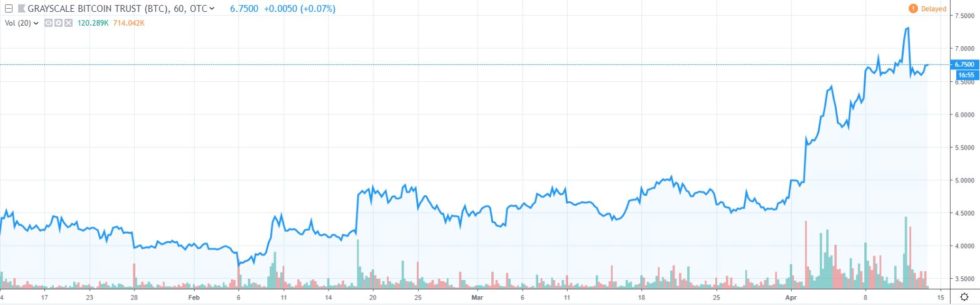

GBTC Soars 47% Since Pre-5K Breakout

GBTC, a product supplied by Grayscale Investments, the world’s largest digital asset fund, is having a fantastic 12 months to date, gaining greater than 56 % prior to now three months.

Extra notably, the product is up 47 % since Bitcoin’s newest rally on April 2nd, whereas Bitcoin’s spot value 00 has elevated by solely 28 %.

In keeping with economist and widespread dealer Alex Krüger, this can be a signal of recent cash coming into the market. He defined:

GBTC 10% at present, outperforming BTC. – GBTC +47% since [April 2nd] breakout – BTC +28% since [April 2nd] breakout One other symptom of recent cash coming into crypto.

Earlier this week, Bitcoinist reported that institutional Bitcoin buying and selling quantity has grown for 4 consecutive months. Nevertheless, GBTC has misplaced some market share dropping to underneath 24 % in comparison with over 50 % on the subject of institutional merchandise.

Nevertheless, the most recent rally of Bitcoin’s value did trigger the property underneath administration (AUM) of Grayscale Investments to surge previous $1 billion. Shortly after that, the asset supervisor elevated the general share of Bitcoin as a part of its composition by 1.5 %.

Why Is The GBTC Premium Rising?

The value of 1 GBTC share is about at 0.00098409 BTC. On the time of this writing, this equals $5. Given the present value of Bitcoin 00, which means that GBTC patrons are fortunately paying a premium value round 37 %. Furthermore, there’s additionally a further 2 % annual price on prime of the premium.

Again in February, when the premium was virtually similar, the top analyst of Fundstrat International Advisors, Tom Lee, commented on the matter, explaining that the rise in premium is an indication of institutional internet shopping for.

CRYPTO: $GBTC premium to NAV creeping as much as 36% on heels of $BTC surge to ~$4,000

Rise in premium is an indication of institutional internet shopping for (simpler to purchase this ETN from @GrayscaleInvest than purchase by way of a crypto trade)…

…one other signal 2019 approach higher than 2018 for crypto pic.twitter.com/hdFh8y3sY9

— Thomas Lee (@fundstrat) February 19, 2019

https://platform.twitter.com/widgets.js

Why Pay a Premium on Bitcoin?

Shares of GBTC are touted to be the primary “publicly quoted securities solely invested in and deriving value from the price of bitcoin.”

GBTC permits institutional buyers to obtain publicity to the worth motion of bitcoin through the use of a conventional funding automobile. In different phrases, buyers don’t have to fret about shopping for, storing, and managing their personal keys.

Furthermore, GBTC shares are additionally eligible to be held in sure IRA, in addition to different brokerage accounts. Therefore why buyers are paying that prime premium in comparison with Bitcoin’s spot value.

It seems that the most recent value surge could have shifted the market sentiment. Bitcoinist reported that Chinese language merchants are fortunately paying a markup for Tether stablecoins, because it gives the simpler approach to purchase Bitcoin in comparison with the Chinese language Yuan (CNY).

What do you consider the efficiency of GBTC and its excessive premium? Don’t hesitate to tell us within the feedback beneath!

Photographs courtesy of Shutterstock, TradingView

The publish GBTC Premium Rises 47% Above Bitcoin Worth Signalling Institutional Demand appeared first on Bitcoinist.com.