Bitcoin generates all of its yearly efficiency positive factors inside simply ten days. Miss these 10 days and your common is 25% down yearly since 2013. Right this moment was a type of days. However are there extra to return? Let’s have a look.

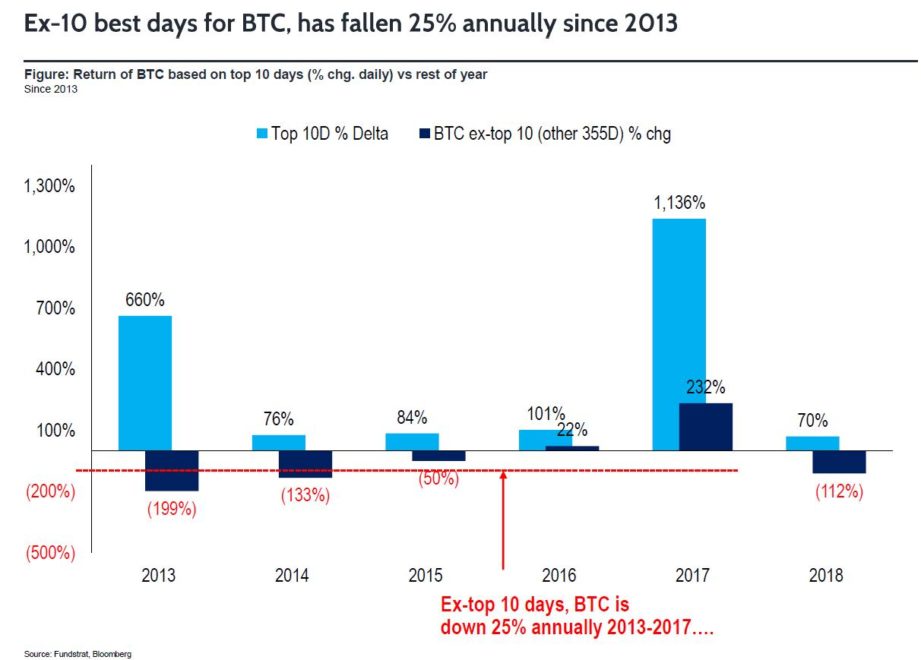

As Bitcoin skyrocketed into the weekend, Tom Lee from Fundstrat was readily available with an fascinating statistic. Specifically, that Bitcoin typically generates all of its efficiency inside simply ten days. Miss these 10 days and your common is 25% down yearly since 2013.

Effectively That Places A Bit Of A Downer On Issues

Does it? It’s a terrific (when it comes to fascinating, not ‘yay!’) statistic, however what does it truly imply? And the way would you calculate a determine like that?

Fortunately, Lee included a helpful diagram together with his tweet.

Proper, so let’s see what we’ve received right here. Prime ten days proportion change, added collectively, so we have now the general proportion positive factors over the 10 finest performing days. Effectively, that is smart; so on 2017’s finest ten days, on common the value greater than doubled (113.6% achieve).

However what about the remainder of the times? Certainly it could make sense to do the identical factor, and easily add up the share change per day?

However let’s say we had two days, one with a 50% achieve and one with a 50% drop. By including the share adjustments we might get zero p.c web change. However in precise truth, the value can be solely 75% of its unique worth.

So, I Haven’t Missed All The Pump This 12 months But?

Solely time will inform. This statistic doesn’t truly make any predictions about that and is of restricted use for the long term.

For individuals who dip out and in of bitcoin this can be of concern as timing the market is relatively troublesome.

Nonetheless, this results in Lee’s prompt tactic to make sure these 10 finest performing days aren’t missed. HODL for the opposite 355 days.

This week’s robust transfer on #crypto and particularly #bitcoin is reminder $BTC traditionally generates its annual efficiency in 10 days. Miss these 10 days and common return is -25%.

Reminder to #HODL https://t.co/DMF5QLi5kH

— Thomas Lee (@fundstrat) Might 11, 2019

https://platform.twitter.com/widgets.js

So HODLers don’t have anything to concern, and for day merchants… the selection of 10 days appears pretty arbitrary. And previous efficiency is not any assure of future outcomes. Particularly since some previous efficiency will definitely by no means repeat and can without end be reserved for the earliest adopters.

Golden Cross Foreshadowed The Value Surge

Lee additionally celebrated the truth that BTC worth 00 has moved above its 200 day shifting common as a optimistic signal. That is what’s generally known as a golden cross and is taken into account to be a really optimistic signal. The final time this occurred, it marked the underside of the earlier bear market.

Different indicators have additionally flashed bullish in current months, forcing many bearish merchants to vary their tune.

Furthermore, Bitcoin performs considerably higher when the value is above the 200MA, with a win ratio of 80% vs 36% when beneath.

This means that we could have a number of extra huge days on the way in which.

Is hodling truly proving to be one of the best funding technique for Bitcoin? Share your ideas beneath!

Photographs through Shutterstock, Twitter/@fundstrat

The submit ‘Hodl’ – Bitcoin Traditionally Generates Its Yearly Positive factors in 10 Days, Says Tom Lee appeared first on Bitcoinist.com.