A brand new Binance Analysis report highlights the correlation between numerous cryptocurrency ‘clusters’ – concluding that Ripple’s XRP token presents a ‘diversifying’ place for traders. On the identical time, diversifying has not been essentially the most profitable technique in terms of decreasing danger based mostly on historic market efficiency.

XRP ‘Best Diversifying’

Binance Analysis launched a report this previous week detailing the correlation between kinds of cryptocurrencies.

It concludes that the biggest cryptocurrencies comparable to Bitcoin and Ethereum exhibited the best constructive correlations or “clusters.” This constructive correlation implies that the costs of Bitcoin and Ethereum are inclined to comply with the identical market traits. As the costs have a tendency to maneuver collectively, traders are then uncovered to related beneficial properties and dangers.

Ripple, alternatively, confirmed much less of a correlation with Bitcoin and Ethereum’s traits and was named “the best diversifier among digital assets with a market cap above $3 billion” within the report.

Earlier stories on the dangers of diversifying cryptocurrencies, nevertheless, recommend that spreading danger throughout altcoins, XRP included, may not be the most secure technique given Bitcoin’s typical market habits.

The Binance research, in the meantime, additionally famous different findings within the relationship between numerous cryptocurrencies.

A single cluster was discovered for the next property:

- Bitcoin Gold

- Bitcoin Money

- Ethereum Basic

- Litecoin

Whereas different cash exhibited value motion from being (or not being) listed on particular exchanges: specifically the “Binance effect” and the “Coinbase listing effect.”

For instance, Tezos and Dogecoin, two property not listed on Binance, every shaped their very own particular person “child” clusters. Whereas for Coinbase, some property have been listed by the corporate additionally shaped related cluster teams (e.g. XLM).

Clusters

The Binance researchers centered on the highest 30 cryptocurrencies by market cap and their USD-equivalent costs have been additionally taken from CoinMarketCap. Although ‘real’ cryptocurrency volumes ought to have additionally been considered.

Stablecoins have been excluded from the research together with any digital asset that was backed by different property “whether they were digital or physical.”

A 30-day rolling common for market caps was used and the 30 “non-backed” largest property have been chosen for the analysis. The date vary coated the interval between March 31st, 2018 and March 31st, 2019.

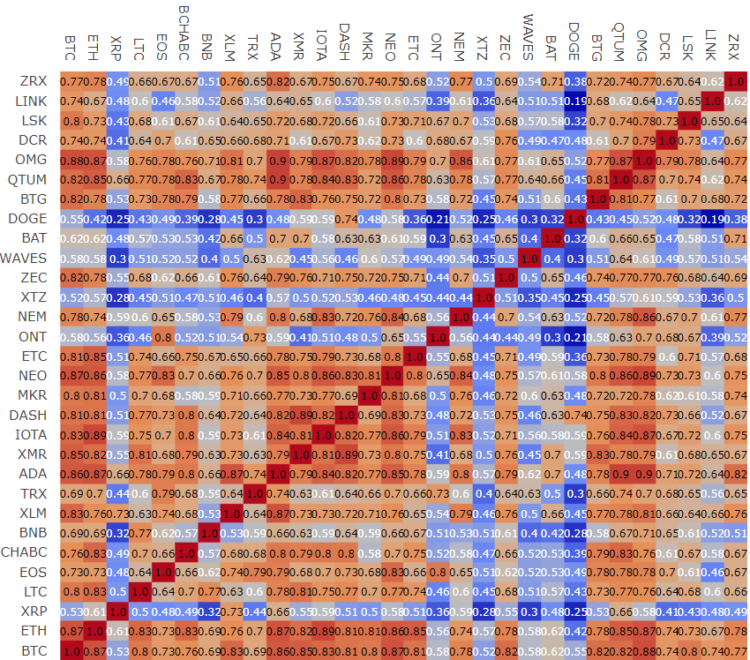

The determine beneath represents the weekly return correlation matrix.

A closing set of clusters have been additionally discovered. The research uncovered that sure “privacy coins” like Sprint and Monero shaped a single cluster.

Nonetheless, in an effort to keep away from drawing absolute conclusions, the report got here with a disclaimer, stating:

However, performing Ok-Means clustering on risk-return profiles of every cryptoasset didn’t return any significant outcomes. One potential rationalization is that return & volatility profiles will not be associated to underlying value co-movements over the research interval.

The Binance group famous that since its earlier report, the general correlation throughout the cryptocurrency market has elevated,” which can be because of the rise of stablecoin quantity, and the corresponding improve in pair choices, in all crypto asset markets,” the report stated.

Earlier this week, Bitcoinist, reported that Bitcoin has pushed the Bitcoin Dominance Index to new highs in 2019 in opposition to alts, although ‘real’ indices put this determine over 80 %.

[Disclaimer: The information contained in this article is intended for educational purposes only and should not be taken as financial advice. Not your keys, not your coins.]

Photographs by way of Shutterstock, Binance analysis

The put up New Binance Report Calls Ripple’s XRP the ‘Best Diversifier’ Digital Asset appeared first on Bitcoinist.com.