A recent analysis by Ryan Watkins, co-founder of Syncracy Capital, highlights Solana’s growing momentum in several key metrics that Ethereum once dominated. However, Watkins notes that running Solana nodes is more expensive amid this revelation.

Solana Is Rallying; Key Metrics Swell

In a post on X, Watkins noted that Solana has surpassed Ethereum regarding decentralized exchange (DEX) and non-fungible token (NFT) volumes, active addresses, transaction count, and stablecoin transfers.

This rapid shift in Solana’s metrics is when the network has been the center of attention among developers and traders. Over the past few trading months, SOL prices have been on a tear, racing past immediate resistance levels and registering new 2023 highs.

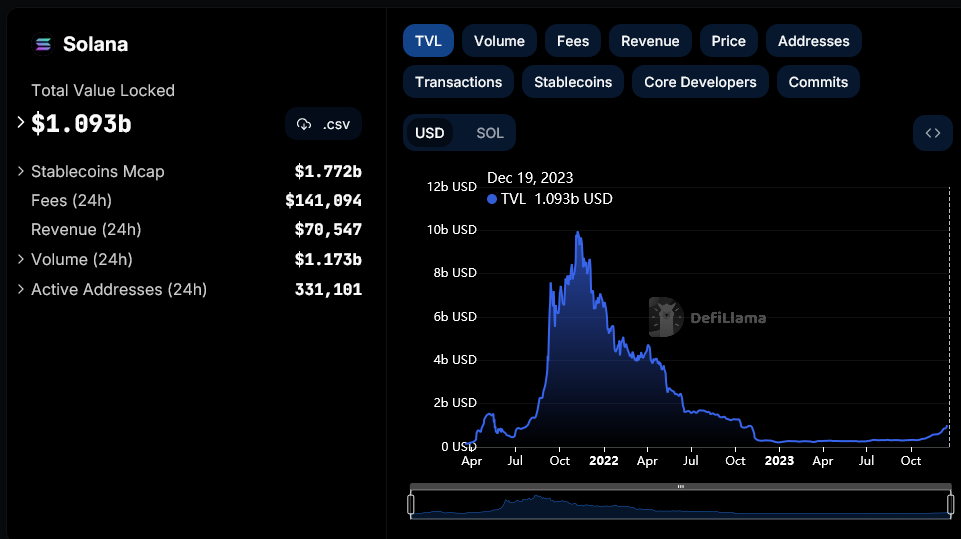

The spike in SOL prices also seems to have rejuvenated on-chain activities, looking at the number of transaction counts and, for instance, the total value locked (TVL). While SOL has more than 3X from September 2023 lows, the network’s decentralized finance (DeFi) TVL, based on DeFiLlama data, is at over $1 billion, more than 3X from July 2023 levels at around $270 million.

The preference for Solana lies in its architecture and scalability, which allows deployed protocols to transact and launch smart contracts cheaply. Central to this is how Solana is structured and their reliance on independent nodes rewarded for their engagement, allowing for decentralization and security.

Cost Of Operating Nodes, Decentralization Comparison Arises

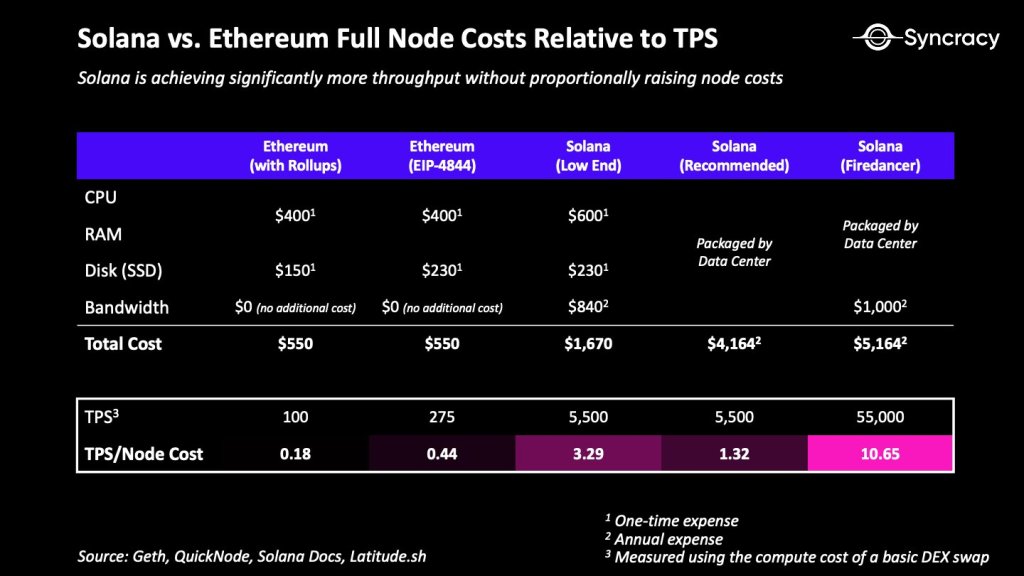

While some have raised concerns about Solana’s decentralization, Watkins points out that Solana has around 40% of the number of nodes as Ethereum. However, the main difference is that Solana nodes are 5X more expensive to run than Ethereum ones. In Watkins’ analysis, the network must bear this cost trade-off in exchange for the high throughput it offers.

Syncrancy data shows that running an Ethereum node costs around $550. Meanwhile, running a high-end node running on Firedancer costs over $5,100. Even so, there is a marked shift in throughput since the Solana node has a TPS of 55,000 versus 100 in Ethereum.

As of December 19, the Nakamoto Co-efficient stands at 21, unchanged. Meanwhile, based on Nakaflow data, Ethereum’s is 2. Usually, the higher the reading, the more decentralized the network is. With this, the tracker suggests that Solana is more decentralized than Ethereum.

Even so, there are over 1 million Ethereum nodes at press time, according to BeaconScan. At the same time, there are more than 2,900 Solana nodes, according to Solana Compass.

Defending Solana, Watkins also acknowledges that decentralization encompasses more than node count and geographic distribution. The co-founder emphasizes the importance of Solana continuing to decentralize its developer ecosystem and implementing features like light clients to ensure cheap end-user verification.

Solana plans to release the Firedancer validator client to diversify, make the network more robust, and improve reliability. Notably, the client will allow implementing nodes to produce blocks faster. This will help the mainnet scale since the network can process more transactions–on-chain without relying on off-chain options and others.

Feature image from Canva, chart from TradingView