A crypto Twitter analyst believes that Tether’s USDT issuances are the true catalyst of the Bitcoin value bull transfer from $4,000 to $13,800.

Bitcoin is just not “Sound Money”

Earlier this week twitter persona Andrew Rennhack steered that Bitcoin’s explosive rally from $4,000 to $13,800 was primarily fuelled by Tether printing an unlimited quantity of USDT. In keeping with Rennhack, Bitcoin is just not “sound money” as “the entire cryptocurrency market is backed by unaudited Tether which has the top 24-hr trading volume.”

Humorously, Rennhack claims that Tether’s USDT issuance price would “make even the FED blush”. Rennhack is of the opinion that there isn’t any affordable rationalization for Bitcoin’s enormous bull run, and he disregards the frequent speaking level that “institutional investors rushed to buy BTC” as a hedge towards inventory market volatility.

A Lengthy Working Conspiracy

Rennhack isn’t the primary particular person to counsel that Tether’s rising market cap instantly impacts Bitcoin value motion. Quite a lot of market analysts and students have reached related conclusions for the reason that finish of 2017’s monster rally.

For the reason that begin of June, greater than $750 million value of USDT had been minted and this issuance intently aligns with Bitcoin meteoric rise to $13,800.

Ethfinex founder, Will Harborne defined that:

While you see a big Tether print it means a handful of rich shoppers have basically preordered batches of Tethers, days upfront, to then dump available on the market–typically earlier than it’s begun to surge. Shopping for important quantities of USDT additionally permits whales to make trades on deeply liquid crypto exchanges that don’t transact in fiat currencies.

Rich traders are required to order a minimal of $100,000 value of Tether to be able to make purchases instantly from Tether’s web site.

The broader crypto-community is made conscious of those transactions via a cryptocurrency monitoring bot referred to as WhaleBot. The bot studies giant transfers and transactions and traders observe these actions and speculate whether or not the crypto market will reply in a bearish or bullish method.

In June, 600 million USDT had been minted and as these cash dripped into the market Bitcoin’s value rose from $8,500 to $11,000. Harborne believes that this single instance is proof that Tether printing results in hypothesis and bullish Bitcoin value motion and he factors to analysis that helps this conclusion.

Not Everybody Agrees

A couple of Twitter followers overtly disagreed with Rennhack’s supposition and Nick Core steered that:

No matter Tether and its points which I don’t contest, you can not say factually that that is the reason for BTC’s rise with out evaluating Tether inflows to the greenback. A market cap rise in USDT from 1.8B to 4B doesn’t logically clarify BTC’s rise in cap from $56B to $198B. FUD

Analysis from a 2017 JP Morgan report seems to assist Rennhack’s estimate. The report discovered that the full crypto-market cap had a multiplier impact of 50x.

In 2017 JP Morgan estimated that almost $6 billion in fiat forex was invested into cryptocurrencies, which resulted in a complete crypto-market cap of $300 billion.

In keeping with Rennhack, $2 billion value of USDT has already been printed in 2019 and Bitcoin at present includes 67% of your entire crypto market. “2 * 50 * 0.67 = 67 billion in fake market cap added to BTC YTP which matches the actual number quite closely.”

Bitcoin’s Market Cap Follows Tether’s

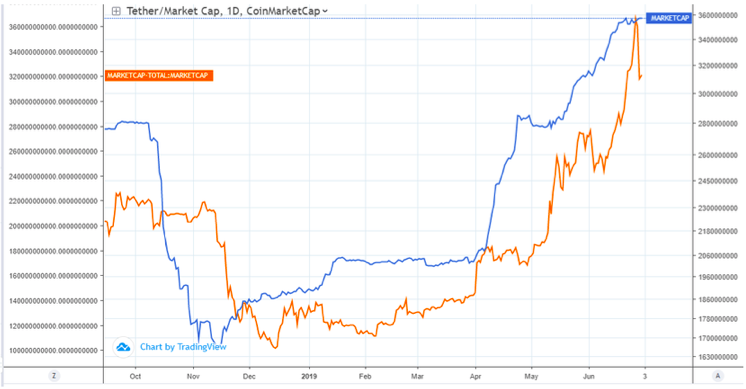

One other attention-grabbing chart evaluating Tether’s market cap to Bitcoin’s market cap has been making its approach across the web.

Shut statement of the chart exhibits that Bitcoin’s market cap tends to lag behind Tether’s.

As of at this time, Bitcoin has not ‘caught up’ to Tether’s will increase and a few analysts imagine that this helps a bullish case for Bitcoin over the short-term.

The Plot Continues to Thicken

Many individuals imagine that Tether’s peculiar methodology of injecting USDT into the crypto market is nothing greater than market manipulation. The New York Lawyer Basic’s workplace is clearly on this camp and most not too long ago Tether has been embroiled in a lawsuit alleging that Tether and Bitfinex illegally operated within the state of New York.

Bitfinex’ed, a crypto-blogger who has intently adopted Tether’s exercise for years, believes:

Bitfinex points tethers to their merchants for market manipulation, market manipulators pump and dump, then ‘pay’ for the tethers later.

Late final week the New York Supreme Courtroom choose overseeing the case postponed issuing a call on the case so it will likely be some time earlier than the group positive factors a deeper perception into the matter.

Do you suppose Tether deliberately manipulates the cryptocurrency market? Share your ideas within the feedback beneath!

Picture through

The submit Tether Behind Bitcoin’s $4000 to $13,800 Bull Rally: Analyst appeared first on Bitcoinist.com.