Bitcoin economist Saifedean Ammous says that nothing has ever risen as quick and as a lot as Bitcoin value – which makes it ‘incomparable’ even to essentially the most profitable firms and innovators.

‘Bitcoin is a Completely New Animal’

Bitcoin economist and writer of The Bitcoin Customary, Saifedean Ammous, not too long ago shared his views on whether or not the world’s hottest cryptocurrency could be in comparison with historical past’s well-known bubbles.

Paul Krugman, Jamie Dimon, Warren Buffet and different critics typically check with Bitcoin as a ‘bubble,’ significantly as BTC/USD value has dropped from almost $20,000 in December 2017 to round $4,000 right now.

However evaluating it to historic inventory market crashes is evaluating apples and oranges, argues Ammous.

“Bitcoin is a completely new animal, different from all before it,” he says.

Your outdated toolbox for analyzing bubbles, currencies, and shares doesn’t work on [Bitcoin].

It’s these outdated instruments that prevented the likes of Buffet from lacking out on among the finest funding alternatives in historical past. Even essentially the most sturdy shares right now, equivalent to Amazon (AMZN), have been outperformed by the digital forex, even at right now’s $4,000 value.

What’s extra, is that after each time the bubble popped, it has come again even stronger. Actually, there have been at the very least 5 80+ % crashes over the previous decade. Ammous notes:

Bitcoin appreciated to 200,000,000% of its worth in 9 years, then crashed again down all the way in which to round a 30,000,000% rise.

In different phrases, had you obtain $100 {dollars} price of bitcoin in 2009, you’ll have about $eight million right now.

Bitcoin ‘Incomparable’ to Historical past’s Well-known Bubbles

The image additionally seems totally different when evaluating Bitcoin towards historical past’s well-known bubbles. It has typically been in comparison with ‘tulips’ within the media with each drop in bitcoin value. However this comparability is broadly inaccurate identical to the frequent misconceptions about Tulipmania as a complete, as a result of BTC value posts a better low after each crash.

“Nocoiners’ favorite bubble, Dutch tulips, lasted for just over 2 years in which the price appreciated around 60-fold, then crashed lower than its original price,” explains Ammous.

It additionally goes with out saying that whereas Bitcoin is the world’s first, borderless, decentralized, impartial cash that allows anybody to ship tens of millions for pennies, the opposite is a flower.

The speed and scale of valuations is one other issue making Bitcoin nothing like the 2008 housing bubble, for instance, when housing costs tripled in twenty years, after which misplaced round 40 % inside only some years.

The well-known housing bubble noticed housing costs triple in round 20 years, after which lose round 40% over a number of years. pic.twitter.com/jb9qkJjkBX

— Saifedean Ammous (@saifedean) March 24, 2019

https://platform.twitter.com/widgets.js

Then there’s the 1929 inventory market bubble that rose six-folds through the Roaring 20s. The following crash noticed costs return to their authentic value. In the meantime BTC/USD continues to be ten occasions larger than its ‘pre-bubble’ value of round $400 in 2016.

Ammous says:

Bitcoin will not be solely incomparable to bubbles, its quick rise can be incomparable to essentially the most profitable firms and innovators. So far as I can inform, nothing has ever risen as quick and as a lot as Bitcoin has risen.

Bitcoin Self-Corrects to Suck Up Fiat

So how did Bitcoin handle to rise a lot and so quick in such a brief timespan? The key lies in its design. Specifically, the inelastic provide of 21 million bitcoin – a quantity set in (digital) stone, making it the toughest type of cash that ever existed.

What’s extra is that not like central banks, the availability (mining) of bitcoin is programmed to develop at a predetermined charge (as much as 21 million).

This makes it essentially the most predictable asset that ever existed. Not solely does everybody know what number of bitcoins will exist 10 and even 100 years from now, however this knowledge can be clear and verifiable.

However Ammous notes one other necessary function that performs an necessary function in Bitcoin economics: the mining problem adjustment.

“My explanation for this rise is that bitcoin’s difficulty adjustment makes it a truly unique monetary asset built to rise fast,” he says.

As lined by Bitcoinist, the issue adjustment acts as a counterbalance to fluctuations in Bitcoin hash charge or computing energy of the community that may with the spot value.

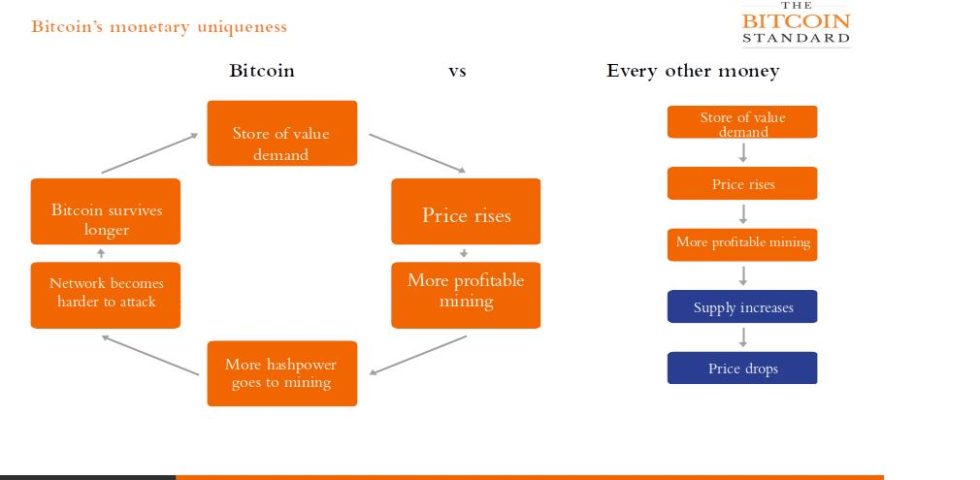

Ammous notes that the distinction between Bitcoin and conventional cash is that the latter is linear, leading to growth and bust cycles. The previous, nevertheless, is a constructive suggestions loop that strengthens the community over time even with erratic value swings.

This makes Bitcoin a unique because it doesn’t behave like a standard asset whose manufacturing is dependent upon provide and demand.

It’s the world’s first self-correcting asset that retains essentially the most environment friendly miners worthwhile no matter market situations whereas siphoning off increasingly more fiat cash by design.

Merely put, Bitcoin will not be the bubble, it’s the pin.

Do you agree that BTC will not be like different historic well-known bubbles? Share your ideas under!

Pictures courtesy of Shutterstock

The put up Why Bitcoin is Incomparable to Historical past’s Well-known Bubbles appeared first on Bitcoinist.com.