Traders mustn’t ignore cryptocurrencies’ menace to incumbent fee companies like Visa, Mastercard, and PayPal, in accordance with Lisa Ellis. In a observe to shoppers, the MoffetNathanson analyst stated that rising use-cases might pose an existential disaster sooner or later.

As Ludicrous As It Might Sound

“Why would I ever buy coffee with bitcoin?” requested Ellis, earlier than making certain her shoppers that it’s a distinct future risk, “as ludicrous as it may sound.”

Although it could sound “ludicrous” to Ellis’ traders, the idea is pretty customary in cryptocurrency circles. In truth, work is properly underway to make it occur — regardless of Ellis’ assurance that it’s unlikely to happen quickly.

As Bitcoinist lately reported, famous Bitcoin bull Tim Draper thinks everyone will probably be doing it in simply two years time. Besides him, after all, as he doesn’t intend to spend or promote any.

Moreover, Starbucks has apparently obtained ‘significant’ fairness in Bitcoin futures platform, Bakkt, to just accept in-store bitcoin funds this 12 months.

Enchancment On Fiat

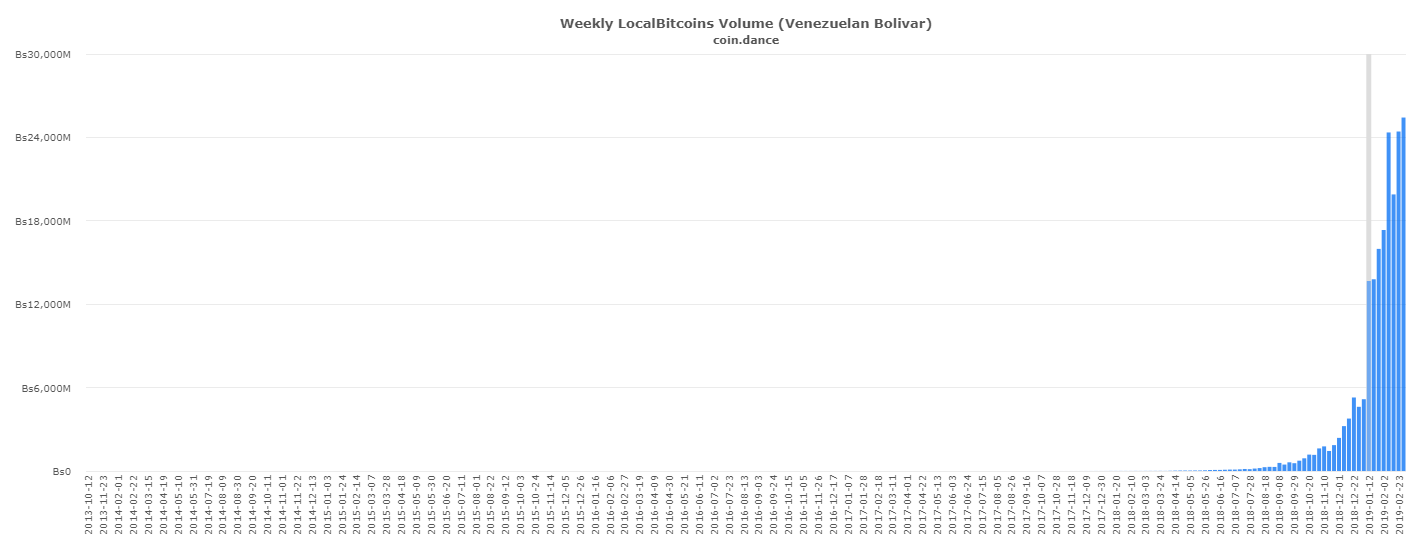

The expansion of Bitcoin use in high-inflation economies is one other issue of concern for the incumbents, in accordance with Ellis:

(Cryptocurrency programs) core design traits — that are aimed toward enabling ‘freedom of money’ — are in direct distinction to the traits of most conventional, non-public fee programs.

She means that the networks additionally must embrace blockchain applied sciences or cede additional floor within the cross-border funds market.

A mix of rising use-cases, relative price-stability, and enhancements similar to Lightning Community implementation, are as soon as extra pushing Bitcoin’s performance as digital cash.

Vanity Comes Earlier than A Larger Fall

One of many biggest threats to non-public fee programs might be their very own conceitedness. Maybe safe of their perception that there is no such thing as a viable various to their companies, they proceed to lift processing charges. Retailers, nevertheless, can solely be pushed up to now and there are indicators of a backlash towards excessive charges — notably with Visa. The profitable implementation of bitcoin fee options might simply upend the hegemony of Visa and Mastercard.

Ellis’ recommendation to shoppers on all three firms (Visa, Mastercard, and Paypal) is to purchase, however for a way for much longer is one other query utterly.

What do you concentrate on Ellis’ recommendation? Tell us your ideas within the feedback under!

Photographs courtesy of Shutterstock, Coin.Dance.

The submit Analyst: ‘Bitcoin Poses Existential Threat To Visa, Mastercard, and Paypal’ appeared first on Bitcoinist.com.