The return of a beforehand well-known phenomenon to Bitcoin this week continues to excite merchants as Bitcoin value pushes above $5250.

Return Of The ‘Kimchi Premium’

Noticed on-line by social media merchants, the so-called ‘Kimchi Premium’ – a surcharge on the Bitcoin value particularly impacting South Korean traders – is making a comeback on native cryptocurrency exchanges.

BTC/USD 00 shot up over $1300 final week to hit an area excessive of $5330. After a slight reversal, momentum reappeared to take the pair above $5000 and maintain it in an space round $5200 ever since.

This, whereas delighting many who’re desperate to name a definitive ‘bottom’ in bitcoin value, has led to uneven spreads throughout exchanges.

As Bitcoinist reported, it was China that led the pattern this month, with the nation’s merchants paying further for buying stablecoin Tether (USDT), their principal entry level into Bitcoin and different cryptocurrencies in a extremely restricted market.

South Korea’s Kimchi Premium, which presents as a markup on Bitcoin value asks immediately, is now following swimsuit, main some to attract comparisons to earlier bullish Bitcoin exercise.

The sample first emerged in late 2017 as BTC/USD aimed for its all-time excessive over $20,000. Thereafter, the Premium got here and went, most not too long ago final October, earlier than Bitcoin’s descent to current lows of $3100.

BTCKRW: Korean premium is showing once more. Similar to earlier than the surge from 4k to 5k.$BTC #bitcoin $btcusd pic.twitter.com/m2n0lvxQn8

— CryptoHamster (@CryptoHamsterIO) April 10, 2019

https://platform.twitter.com/widgets.js

In its newest incarnation, in response to knowledge from South Korean trade Korbit, the premium is main Koreans to pay 6.05 million received per bitcoin, in opposition to a USD value of $5230. This represents a markup of round 1.5 p.c.

Woo Evaluation Suggests Backside Is In

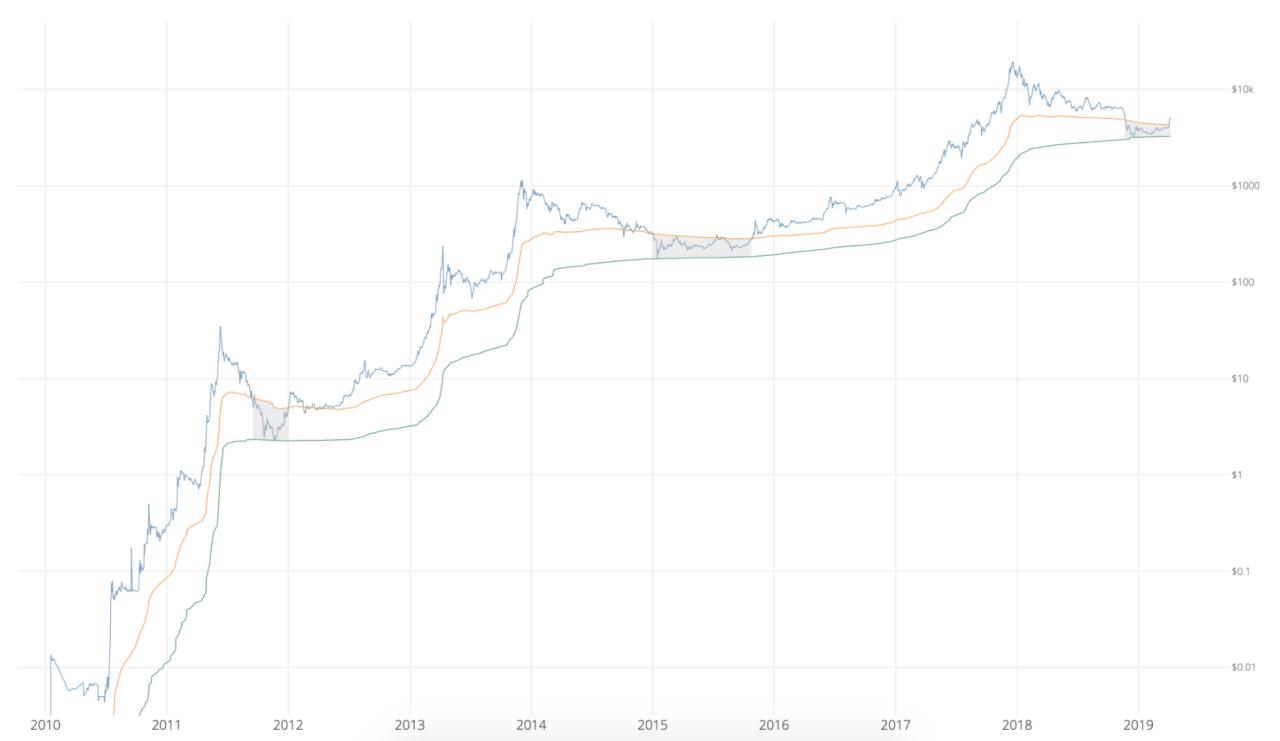

In the meantime, additional proof bitcoin value might have bottomed out up to now months has come from impartial analyst Willy Woo. In an replace to his Woobull weblog, Woo prolonged his Bitcoin value measurements in an try to position its current lows in context.

His newest metric, Cumulative Worth Days Destroyed (CVDD), focuses on transactions, and is remarkably correct when utilized to earlier bear market lows.

“When a HODLer sells to another HODLer the transaction contains both value (USD) and a length of prior HODL time,” he defined.

CVDD is the cumulative sum of this worth and time destruction for each on-chain transaction (adjusted by age of market which brings the models again into USD).

If Woo is right, the newest backside ought to already be behind Bitcoin, with the surge above $5000 the beginning of a recent longer-term uptrend.

As Bitcoinist famous, nonetheless, not everyone seems to be satisfied, with veteran dealer Tone Vays this week main calls to deal with the newest Bitcoin value efficiency with skepticism.

What do you consider the return of the Kimchi Premium and Willie Woo’s mannequin? Tell us within the feedback beneath!

Pictures through Shutterstock, woobull.com

The submit Bitcoin’s Key Indicator Flashing Bullish Once more, Mirroring Pre-5K Breakout appeared first on Bitcoinist.com.