A brand new report from curated knowledge platform Diar reveals that institutional Bitcoin buying and selling volumes file progress for the 4th month in a row.

Establishments Warming Up

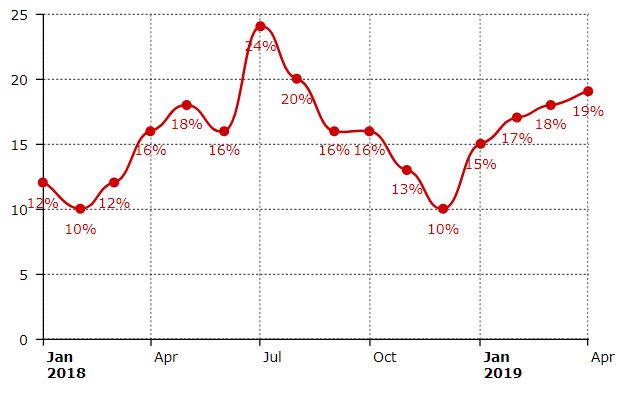

Common cryptocurrency knowledge outlet Diar studies that institutional Bitcoin buying and selling volumes have moved into progress for the 4th consecutive month. Based on the report, they’re hitting new highs in opposition to US-based exchanges as a proportion of the full buying and selling quantity.

As seen on the chart, the present quantity is round 9 % extra in comparison with December 2018.

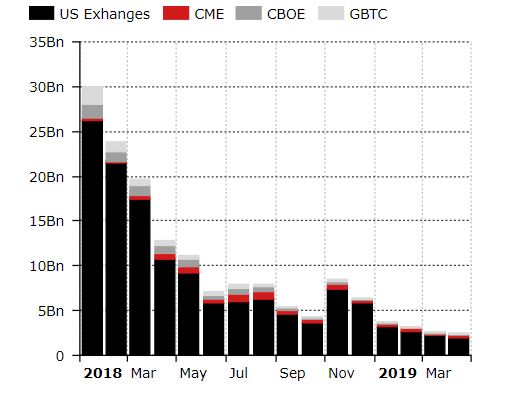

Notably, CBOE is the most important loser, which doesn’t come a lot as a shock. The Chicago Board Choices Change revealed in March that it’s going to now not supply any new contracts for its cash-settled XBT Bitcoin futures product shifting ahead.

CME Group, then again, is marking features. As Bitcoinist reported final week, CME Bitcoin futures quantity soared 950 % on April 4th in comparison with the start of the month. As of Monday, April eighth, CME noticed round 16,000 Bitcoin futures contract.

Grayscale’s Bitcoin Funding Belief (GBTC) which is traded on OTC markets has additionally misplaced dominance. The report outlines that GBTC has accounted for over 50 % of the complete market share in the case of institutional merchandise however it’s now standing in lower than 24 %.

Declining Worth Didn’t Have an effect on Institutional Demand

Bitcoin has gone by a 15-month bear market, which dragged Bitcoin’s worth all the way down to yearly lows of round $3,200 from an all-time excessive of $20,000. In different phrases, the cryptocurrency is down round 85 % from its peak.

Based on Diar’s report, nonetheless, the decline in worth didn’t translate into extra institutional demand, maybe hinting that worth isn’t such a outstanding issue for establishments.

In any case, the rising curiosity in institutional Bitcoin buying and selling merchandise might be interpreted as a bullish signal. Nevertheless, veteran buying and selling knowledgeable Tone Vays has warned that Bitcoin’s latest rally doesn’t essentially imply that the bear is over.

Others, nonetheless, have advised that worth might have bottomed because it’s now resembling a sample seen previous to the earlier bull-run if not a brand new parabolic advance.

What do you consider the expansion marked by institutional Bitcoin buying and selling merchandise? Don’t hesitate to tell us within the feedback beneath!

Photos through Shutterstock, Diar

The submit Institutional Bitcoin Buying and selling Quantity Grows For four Consecutive Months appeared first on Bitcoinist.com.