The most recent decentralized finance (DeFi) goals at creating new enterprise options constructed on distributed, permissionless networks. A Binance Analysis examine reveals that DeFi has grown spectacularly in lower than a yr.

Ethereum-Based mostly Defi Apps Are Price over $500 Million

On June 6, 2019, Binance Analysis launched a examine specializing in platforms and lending and borrowing protocols that intend to seriously change the monetary trade, reminiscent of DeFi.

Researchers outline DeFi, as follows:

An ecosystem comprised of functions constructed on decentralized networks, permissionless blockchains, and peer-to-peer protocols for the facilitation of lending/borrowing or buying and selling with monetary devices.

Bitcoin and Ethereum networks had been the primary networks to run DeFi functions. Presently, many of the DeFi protocols run on Ethereum.

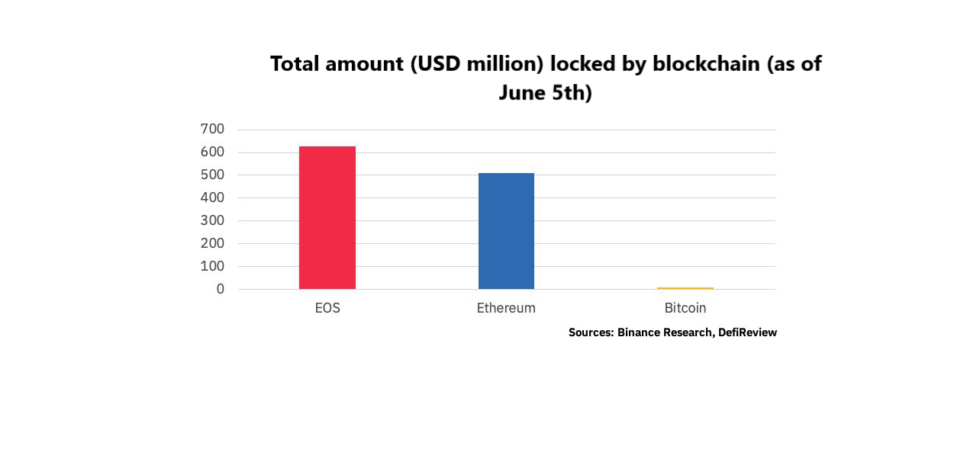

Based on the examine as of June 5, 2019, the worth of Ethereum-based DeFi functions reached over $500 million. And DeFi functions working on the Bitcoin community quantity to roughly $eight million.

Most surprisingly nonetheless, EOS has surged as the most important community working a DeFi software, by way of collateral worth. EOS boasts greater than $600 million locked by its blockchain, as of June 5, 2019. The chart beneath refers.

The examine highlights that DeFi platforms provide totally different incentives for market members. Particularly,

• For debtors: the power to brief an asset or borrow utility (e.g., governance rights).

• For lenders: the power to insert capital to make use of and earn curiosity.

• For each: arbitrage alternatives throughout platforms.

“DAI Is One of the Central Components of the DeFi Ecosystem”

The big selection of belongings supported on Ethereum-based platforms includes two classes: native blockchain belongings and non-native block belongings.

Native blockchains belongings are outlined as belongings whose worth just isn’t backed by any non-native blockchain asset reminiscent of a commodity, fairness, or fiat forex.

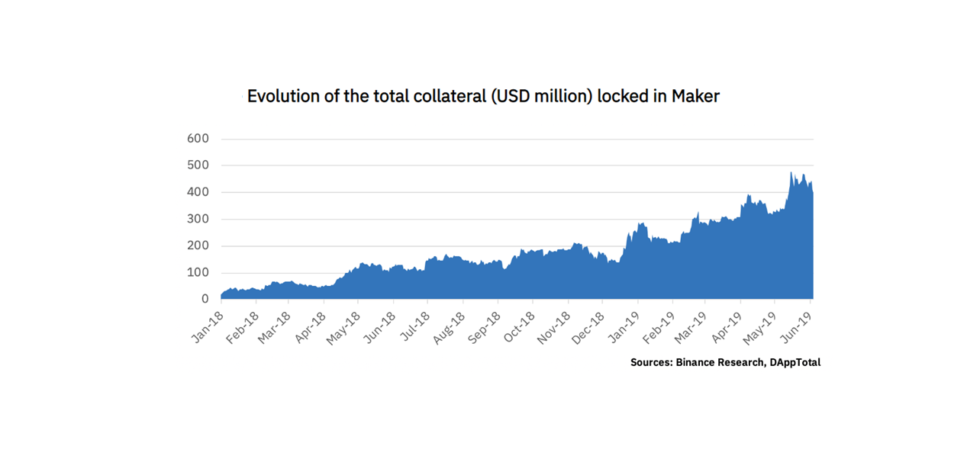

MakerDao (MKR) and its DAI stablecoin is an instance of a local blockchain asset. DAI’s worth is pegged to the U.S. greenback by good contracts. The examine stresses that DAI is likely one of the most vital parts of the DeFi ecosystem constructed on Ethereum.

Different examples of native belongings embody ERC-20 tokens, reminiscent of Augur (REP), Primary Consideration Token (BAT), and 0x (ZRP).

These crypto-assets can be utilized as collateral for a mortgage, lendable belongings, borrowable belongings, and governance belongings (e.g., Maker/MKR).

Conversely, non-native blockchain belongings are stablecoins collateralized by fiat cash on financial institution accounts.

One of many Most Lively Sectors of Blockchain in 2019

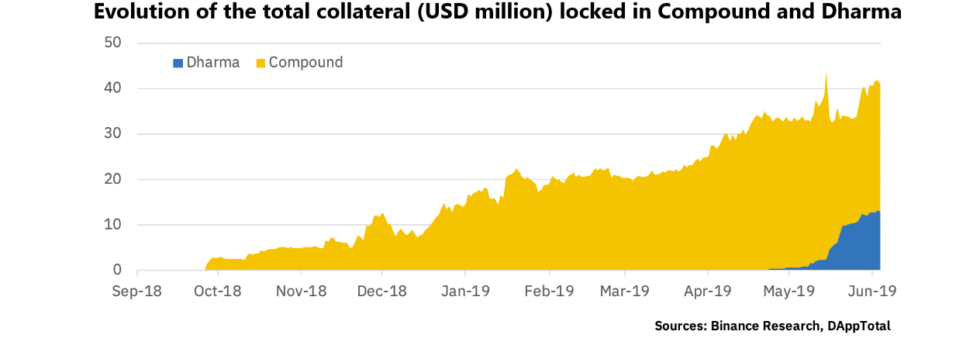

The examine finds that Ethereum is at the moment the usual default platform for a lot of decentralized functions, such because the lending and borrowing protocols, Compound and Dharma. Each lending platforms have seen fixed development since their launch.

In lower than a yr, DeFi has grown to develop into some of the lively sectors of blockchain in 2019, in accordance with Concensys.

Furthermore, the Binance Analysis examine forecasts,

DeFi, as illustrated by these lending and borrowing platforms, seems as top-of-the-line use-cases of blockchain know-how which may attain as much as billions of customers throughout the globe and permit entry to primary monetary providers at environment friendly charges.

How do you suppose DeFi is disrupting the monetary system? Tell us your ideas within the feedback beneath!

Pictures through Binance analysis, DAppTotal, Shutterstock

The put up Decentralized Finance (DeFi) Rising To Attain ‘Billions of Users’ Research Finds appeared first on Bitcoinist.com.