The most recent surge in Bitcoin value could have been brought on by elevated exercise throughout the board because the variety of lively wallets has risen by as a lot as 40-60 p.c, in response to the most recent information and trade analysts.

Current Rally ‘Much More Valid’

Citing analysts from market intelligence firm Flipside Crypto, Bloomberg reported that numerous idle Bitcoin wallets have turn out to be lively. Based on the report, dormant wallets which have been inactive from one to 6 months, have decreased by 40 p.c since March 15th.

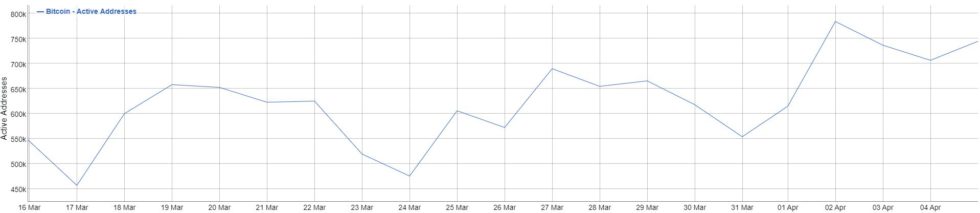

It’s additionally value noting that the variety of distinctive lively Bitcoin every day addresses has elevated tantamount to the drop since March 15th, additional supporting their claims.

Commenting on the matter was Eric Stone, co-founder, in addition to head of information science at Flipside, who famous:

If you’re a crypto optimist, that’s excellent news. […] There are extra folks warming as much as the concept of shopping for Bitcoin.

The CEO of the corporate has additionally outlined that the most recent rally was “much more valid” in comparison with Bitcoin’s surge final fall in October. Based on him, it’s as a result of many smaller wallets are “waking up,” and never due to a “few whale moves.”

We see this transfer way more legitimate than just a few whale strikes in October. […] This in all probability signifies a change in notion or confidence on this asset class.

Apparently sufficient, again in March, one other in style Bitcoin proponent, the chief analyst at Fundstrat World Advisors, Tom Lee, additionally introduced up the subject of lively wallets, outlining it as a cause for future development.

In a world the place there are 50 million lively wallets at this time and 5 billion Visa cardholders, clearly the crypto market can simply develop due to adoption.

However Is This Actually the Case?

Whereas an elevated quantity in lively Bitcoin wallets can undoubtedly be seen as considerably a optimistic signal, it’s questionable if that was actually the trigger for the current value surge.

Citing trade knowledgeable Oliver Von Landsberg-Sadie, CEO at cryptocurrency agency BCB Group, Reuters reported that Bitcoin’s rally was “probably” triggered by a $100 million order unfold throughout cryptocurrency exchanges Kraken, Bitstamp, and Coinbase.

There was a single order that has been algorithmically-managed throughout these three venues, of round 20,000 BTC. […] In the event you take a look at the volumes on every of these three exchanges – there have been in-concert, synchronized, models of quantity of round 7,000 BTC in an hour.

The transfer, as additional reported, has managed to set off a frenzy of algorithmic hedge fund buying and selling. This can be a methodology which takes benefit of automated software program to determine developments and to find out when trades ought to be carried out.

Actually, 17 new algorithm buying and selling hedge funds have launched since September final yr, in response to Bloomberg, purportedly comprising 40 p.c of cryptocurrency hedge funds all through the interval.

Is Bitcoin’s newest rally for actual or just a pump by whales? Tell us within the feedback beneath!

Photographs through Shutterstock, BitInfoCharts

The publish Individuals Are ‘Waking Up’ – 40% Drop in Dormant Wallets Fueling Bitcoin Rally appeared first on Bitcoinist.com.