Sky’s the restrict for Bitcoin, whose market capitalization might attain $100 trillion when wanting on the historic traits of the US greenback and the world’s hottest cryptocurrency facet by facet.

Greenback’s Inflation is a Characteristic

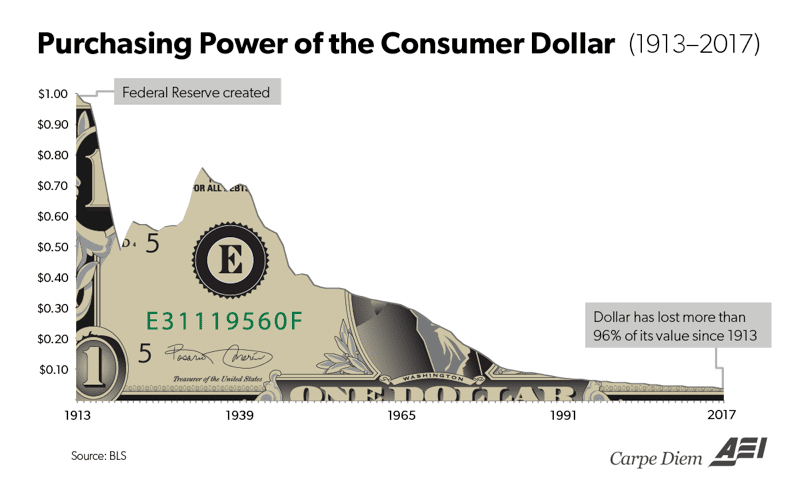

April Fools Day apart, the one predictable factor concerning the US Greenback is that its buying energy will proceed to drop.

Since 1913, the yr the Federal Reserve was established, the greenback has misplaced over 96 % of its worth.

General, costs in 2016 have been 2,324 % larger than common costs in 1913, in accordance to the Bureau of Labor Statistics shopper value index. In different phrases, the world’s reserve foreign money skilled a median annual inflation charge of 3.14% during the last century.

General, costs in 2016 have been 2,324 % larger than common costs in 1913, in accordance to the Bureau of Labor Statistics shopper value index. In different phrases, the world’s reserve foreign money skilled a median annual inflation charge of 3.14% during the last century.

What’s extra, different fiat currencies, significantly in growing economies have fared a lot worse. Some just like the Algerian Dinar, for instance, have misplaced roughly 80 % towards the USD up to now 5 years alone.

Because the greenback is inherently designed to lose worth over time, retaining your hard-earned cash in fiat foreign money abolutely ensures that not less than Three % of your wealth will evaporate yearly.

Inflation charges:

1. Venezuela 2,688,670%

2. Iran 399%

3. South Sudan 117%

4. Argentina 47%

5. Congo 41%

6. Libya 32%

7. Angola 30%

8. Sudan 26%

9. Syria 25%Bitcoin is the lifeboat.

— The Rhythm Dealer (@Rhythmtrader) March 31, 2019

https://platform.twitter.com/widgets.js

Bitcoin Hit Greenback Parity 7 Years In the past

When Bitcoin first launched in 2009 as a response to the monetary disaster, it was thought-about a pipe dream for it to achieve $1 greenback per bitcoin.

Miraculously, it solely took BTC 2 years to achieve parity. This occurred 7 years in the past on February ninth, 2011 on the doomed Mt. Gox platform, which was just about the one alternate on the time.

This was the interval of the notorious ‘bitcoin pizza‘ and a few of the feedback from this period appear fairly amusing immediately. For instance, one dealer wrote:

I didn’t think about BTC again in February, and now it’s buying and selling at virtually $30.

Oh, regrets, regrets, regrets….

.

Others’ FOMO was much more palpable.

In the meantime, savy merchants had a lot decrease time-preference, for which they’ve been drastically rewarded within the following years as costs noticed three, 4 and even five-figure sums.

It’s these percipient traders who discovered the chance and reward ratio to be too enticing. They knew that there would solely ever be 21 million bitcoin. Alternatively, the provision of {dollars} on the planet is within the tens of trillions and ever-expanding.

What’s extra, this doesn’t even keep in mind the derivatives market, which is estimated at greater than 10 instances of the overall world’s GDP. This largely unregulated sector is definitely thought-about to be one of many greatest dangers to the worldwide financial system and will comprise a staggering $1.2 quadrillion USD.

Bu…However Bitcoin Worth Crashed!

Evaluating Bitcoin valuation to tulips, the dot-com bubble and different market phenomenon is akin to jamming a sq. peg right into a spherical gap.

Its provide is ready in stone at 21 million. It’s digitally scarce. Its emission charge is predetermined. Its accounting is clear and publicly verifiable. It’s not a commodity because it doesn’t observe provide and demand (which might clarify its volatility). But it’s additionally not a foreign money or authorized tender because it’s outdoors purview of any authorities or central authority.

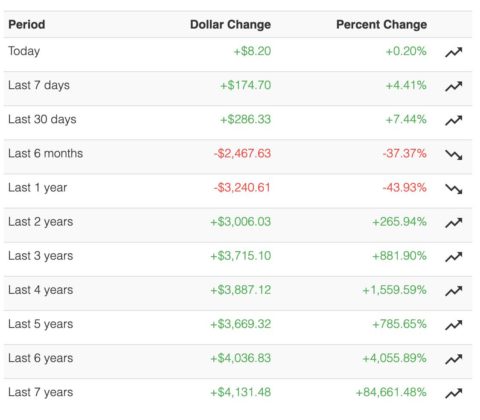

Bitcoin is in contrast to something the world has ever seen. It’s ‘Money 2.0’ that has appreciated over 84,000 % towards the US greenback over the previous 7 years.

Bitcoin Doesn’t Care

Therefore, it’s no marvel that it’s gaining a foothold in nations with capital controls like Venezuela the place cash is now nearly nugatory. However developed nations may also quickly understand that Bitcoin is alive and properly regardless of the lots of of obituaries within the press.

On the similar time, regardless of crashing towards the greenback a number of instances all through its historical past, BTC all the time recovers to submit larger lows.

Subsequently, maybe we cease wanting on the crash from $20,000. As a substitute, it might be time to start out wanting on the historic yearly lows, which reveal an attention-grabbing development certainly.

- 2012 – $4

- 2013 – $65

- 2014 – $200

- 2015 – $185

- 2016 – $365

- 2017 – $780

- 2018 – $3200

- 2019 – ?

Bitcoin is a Black Gap for Fiat

Immediately, rates of interest are at historic lows. The Federal Reserve and different central banks have proven that they are going to proceed to not solely print extra money to prop up the monetary system, however are additionally open to adverse rates of interest as properly.

Subsequently, the query stays is when — not if — all this newly created cash will set off hyperinflation.

Bitcoin, however, continues to mine blocks and ensure transactions 24/7 with an uptime of 99.983 % in its ten years of existence. On the similar time, virtually 85 % of all bitcoin have already been mined.

With BTC value now as soon as once more forming a backside sample, the development seems to be in tact. In truth, the US greenback has already dropped 10 % in worth towards bitcoin in Q1 2019.

Shares and bonds have additionally rallied within the first quarter of this yr as central Banks have pumped virtually $1 trillion in liquidity into world markets, notes market analyst Holger Zschaepitz.

QE will print #bitcoin to $100trillion

https://t.co/EuXsxnbHRR

— plan₿ (@100trillionUSD) March 31, 2019

https://platform.twitter.com/widgets.js

Bitcoin market analyst planB, although, believes the development is apparent. He believes that Quantative Easing (QE) means bitcoin will finally hit a market cap of $100 trillion because the greenback ‘prints’ up its value.

As Bitcoinist reported, the analyst just lately shared a brand new mannequin that places Bitcoin at a $1 trillion greenback market cap a while in 2020 after the Could halving. The occasion may also mark the beginning of the interval when Bitcoin’s inflation charge will drop beneath 2 %, i.e. the Federal Reserve’s inflation goal.

Will Bitcoin attain $100 trillion market cap sooner or later? Share your predictions beneath!

Pictures by way of Shutterstock, coin.dance, Bitcoinist archives

The submit Not April Fools: Why the US Greenback Will ‘Print’ Bitcoin to $100 Trillion appeared first on Bitcoinist.com.