With Bitcoin spiking greater than 120 % because the begin of 2019, the U.S. Inner Income Service (IRS) says it’s readying an up to date set of pointers to cowl cryptocurrency taxation.

IRS Getting ready Extra Crypto Tax Tips

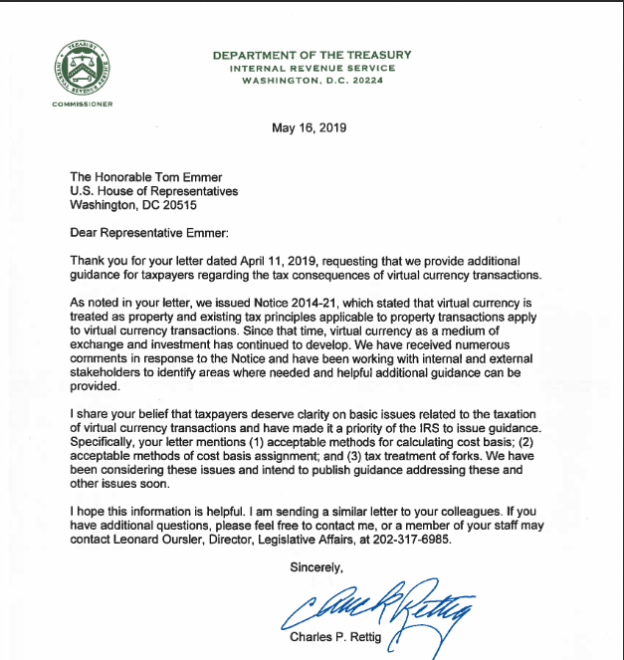

In a letter to a bipartisan group of U.S. Congressmen, the IRS Commissioner Charles Rettig declared that clear-cut Bitcoin tax pointers had been a prime precedence for the company. The letter was in reply to an April 2019 letter from the 21-member congressional coalition led by Rep. Tom Emmer (R-MN).

An excerpt from the reply despatched by Commissioner Rettig reads:

I share your perception that taxpayers deserve readability on primary points associated to the taxation of digital foreign money transactions and have made it a precedence of the IRS to problem steering. Particularly, your letter mentions (1) acceptable strategies for calculation price foundation; (2) acceptable strategies of price foundation task; and (3) tax remedy of forks. We’ve been contemplating these points and intend to publish steering addressing these and different points quickly.

The timing of the IRS’ assertion comes as Bitcoin in having fun with a stellar worth run, having greater than doubled since January 2019.

How well timed… BTC spikes and the IRS commissioner decides to remark 😉

— Crypto Tax Lady (@CryptoTaxGirl) Might 21, 2019

https://platform.twitter.com/widgets.js

As beforehand reported by Bitcoinist on a number of events, there have been requires a extra definitive construction for Bitcoin taxation within the U.S. A number of establishments and stakeholders have decried the ambiguous nature of the present IRS crypto tax framework developed in 2014.

Each the American Institute of CPA and the Treasury Division have beforehand known as on the IRS to offer clear steering on the Bitcoin taxation course of. Many critics of the present framework say taxpayers bear an excessive amount of of a burden making an attempt to comply with pre-emptive steps to keep away from falling into the difficulty of cryptocurrency-related tax evasion expenses.

Bitcoin is Each Forex and Property

Again in 2014, the IRS selected to not acknowledge Bitcoin and different cryptos as currencies, characterizing them as property. Thus, their change falls underneath the purview of capital good points tax.

Quick-forward to 2018 and the IRS says cryptos are a digital illustration of worth akin to conventional fiat foreign money. This declaration opens the door to revenue tax issues for digital foreign money transactions.

Shopping for crypto isn’t a taxable occasion.

Promoting crypto for fiat (e.g., USD) is a taxable occasion.

Buying and selling one coin for an additional is a taxable occasion.

Utilizing crypto to buy items or companies is a taxable occasion.

— Crypto Tax Lady (@CryptoTaxGirl) July 11, 2018

https://platform.twitter.com/widgets.js

Then there are additionally the implications of utilizing Bitcoin and different cryptocurrencies to make purchases. Again in March 2019, Bitcoinist reported that the proposed Bitcoin for Starbucks espresso as a part of the Bakkt–Starbucks settlement would possibly convey up extra BTC tax submitting palaver.

I commerce the “magical internet money” on infrastructure that doesn’t belong to ANY sovereign state, it’s a non productive asset relying on zero state owned widespread items, to keep away from sovereign theft, aka taxation

Paying “capital gain” tax for such exercise is such a joke LMFAO

— Dovey Wan

(@DoveyWan) Might 20, 2019

https://platform.twitter.com/widgets.js

There are, nonetheless, stakeholders within the business who consider cryptocurrency shouldn’t fall underneath authorities tax. Tweeting on Monday, Dovey Wan of Primitive declared that paying capital good points tax of cryptocurrency transactions was “a joke.”

Do you suppose taxes on cryptocurrencies are lawful? Tell us within the feedback under.

Photos through Coincenter.org ,Twitter @CryptoTaxGirl, @DoveyWan, Shuterstock

The publish Of Course, The IRS is Updating Its Bitcoin Tax Tips as Value is Rising appeared first on Bitcoinist.com.